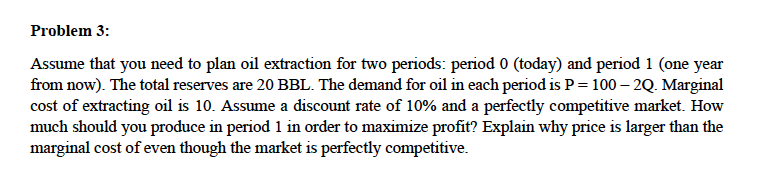

Question: Problem 3: Assume that you need to plan o1l extraction for two periods: period 0 (today) and period 1 (one year from now). The total

Problem 3: Assume that you need to plan o1l extraction for two periods: period 0 (today) and period 1 (one year from now). The total reserves are 20 BBL. The demand for o1l 1n each period 1s P = 100 2Q. Marginal cost of extracting o1l 1s 10. Assume a discount rate of 10% and a perfectly competitive market. How much should you produce in period 1 in order to maximize profit? Explain why price 1s larger than the marginal cost of even though the market 1s perfectly competitive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts