Question: Problem 3: Bad Debt Expense (12 marks) VERSION 5 At December 31, Y5; Aylmer Inc had the follow amounts related to accounts receivable: Total sales

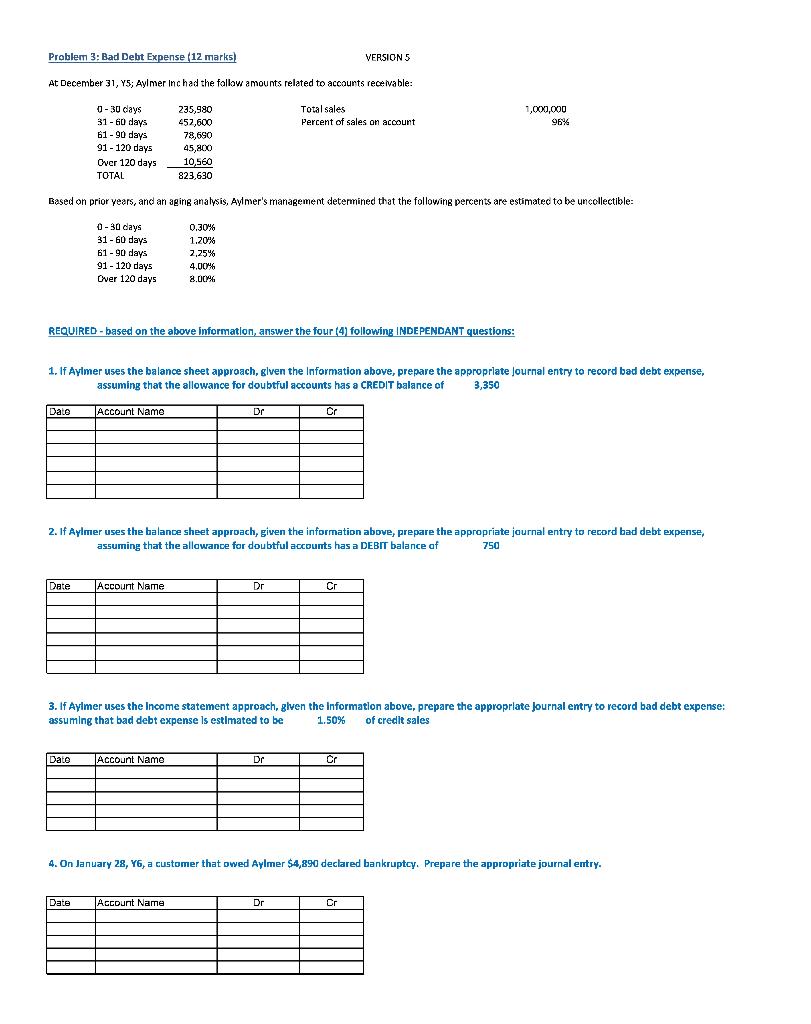

Problem 3: Bad Debt Expense (12 marks) VERSION 5 At December 31, Y5; Aylmer Inc had the follow amounts related to accounts receivable: Total sales Percent of sales on account 1,000,000 96% 0 - 30 days 31-60 days 61 - 90 days 91 - 120 days Over 120 days TOTAL 235,980 452,600 78,690 45,400 10,560 823,630 Based on prior years, and an aging analysis, Aylmer's management determined that the following percents are estimated to be uncollectible: 0-30 days 31-60 days 61-90 days 91 - 120 days Over 120 days 0.30% 1.20% % 2,25% 4.00% 2.001% REQUIRED - based on the above information, answer the four (4) following INDEPENDANT questions: 1. If Aylmer uses the balance sheet approach, glven the Information above, prepare the appropriate Journal entry to record bad debt expense, assuming that the allowance for doubtful accounts has a CREDIT balance of 3,350 Date Account Name Dr Cr 2. If Aylmer uses the balance sheet approach, given the information above, prepare the appropriate journal entry to record bad debt expense, assuming that the allowance for doubtful accounts has a DEBIT balance of 750 Date Account Name Dr 3. If Aylmer uses the Income statement approach, glven the Information above, prepare the appropriate Journal entry to record bad debt expense: assuming that bad debt expense is estimated to be 1.50% of credit sales Date Account Namo Dr Cr 4. On January 28, 76, a customer that owed Aylmer $4,890 declared bankruptcy. Prepare the appropriate journal entry. Date Account Name Dr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts