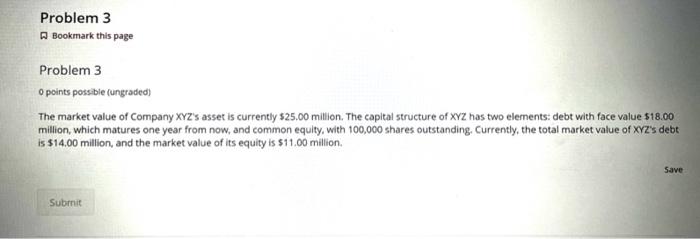

Question: Problem 3 Bookmark this page Problem 3 O points possible (ungraded) The market value of Company XYZ's asset is currently $25.00 million. The capital structure

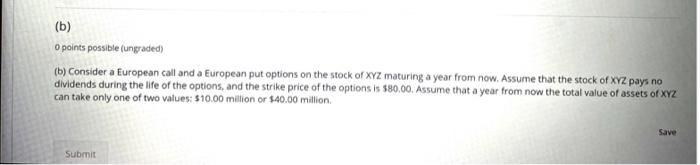

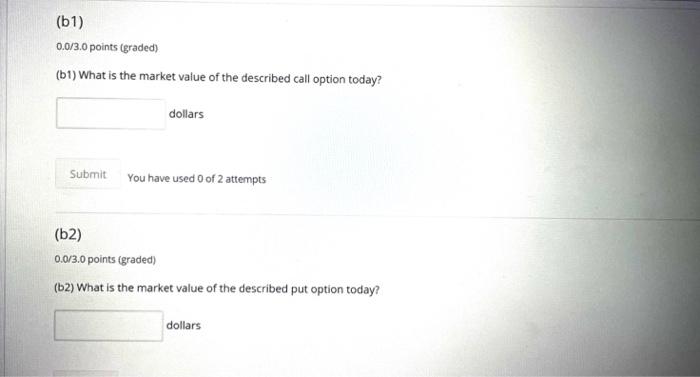

Problem 3 Bookmark this page Problem 3 O points possible (ungraded) The market value of Company XYZ's asset is currently $25.00 million. The capital structure of XYZ has two elements: debt with face value $18.00 million, which matures one year from now, and common equity, with 100,000 shares outstanding. Currently, the total market value of XYZ's debt is $14.00 million, and the market value of its equity is $11.00 million Save Submit (b) O points possible (ungraded (b) Consider a European call and a European put options on the stock of XYZ maturing a year from now. Assume that the stock of XYZ pays no dividends during the life of the options, and the strike price of the options is $80.00. Assume that a year from now the total value of assets of XYZ can take only one of two values: 510.00 million or $40.00 Million Save Submit (61) 0.0/3.0 points (graded) (61) What is the market value of the described call option today? dollars Submit You have used 0 of 2 attempts (62) 0.0/3.0 points (graded) (b2) What is the market value of the described put option today? dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts