Question: Problem 3 Boris Corporation started operations on March 1, 2017. It needs to acquire a special piece of equipment for its manufacturing operations. It is

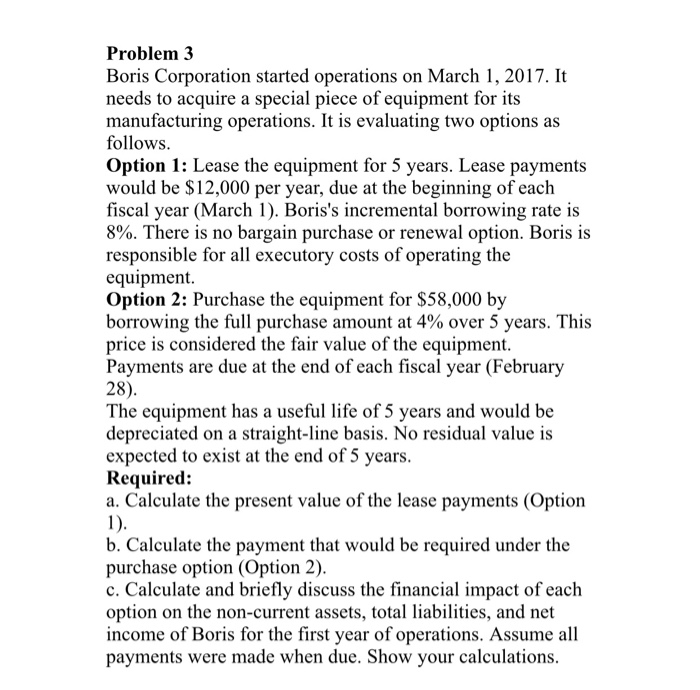

Problem 3 Boris Corporation started operations on March 1, 2017. It needs to acquire a special piece of equipment for its manufacturing operations. It is evaluating two options as follows Option 1: Lease the equipment for 5 years. Lease payments would be $12,000 per year, due at the beginning of each fiscal year (March 1). Boris's incremental borrowing rate is 8%. There is no bargain purchase or renewal option. Boris is responsible for all executory costs of operating the equipment Option 2: Purchase the equipment for $58,000 by borrowing the full purchase amount at 4% over 5 years. This price is considered the fair value of the equipment Payments are due at the end of each fiscal year (February 28) The equipment has a useful life of 5 years and would be depreciated on a straight-line basis. No residual value is expected to exist at the end of 5 years Required: a. Calculate the present value of the lease payments (Option 1) b. Calculate the payment that would be required under the purchase option (Option 2) c. Calculate and briefly discuss the financial impact of each option on the non-current assets, total liabilities, and net income of Boris for the first year of operations. Assume al payments were made when due. Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts