Question: Problem 3 - Chapter 6 Journal Entries. Record the following transactions in general journal form related to the debt activities of the City of Layton

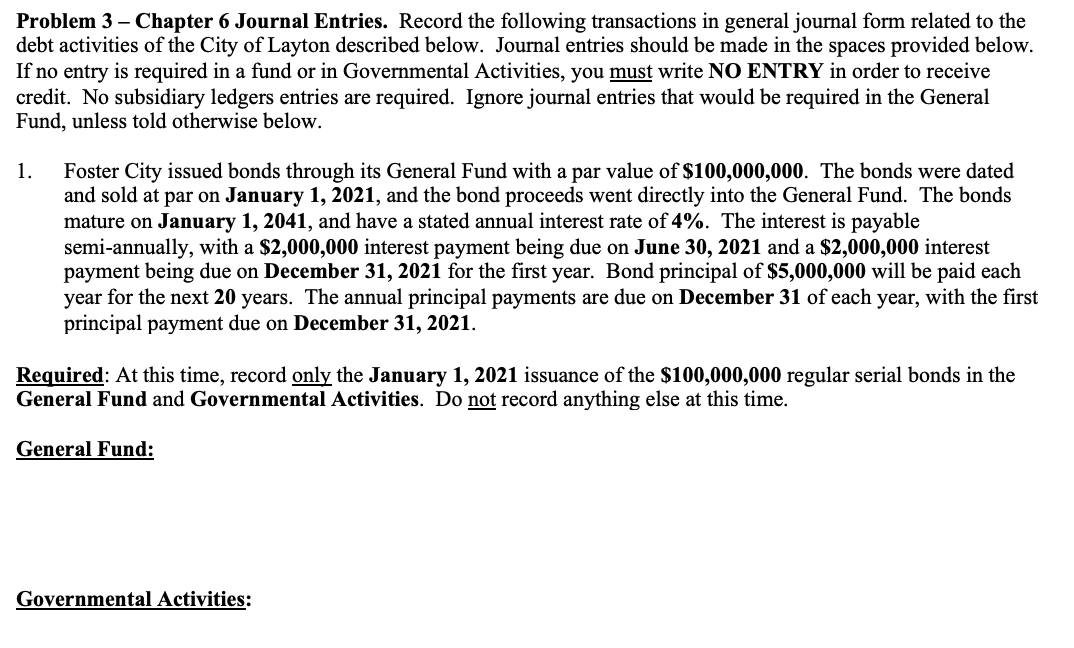

Problem 3 - Chapter 6 Journal Entries. Record the following transactions in general journal form related to the debt activities of the City of Layton described below. Journal entries should be made in the spaces provided below. If no entry is required in a fund or in Governmental Activities, you must write NO ENTRY in order to receive credit. No subsidiary ledgers entries are required. Ignore journal entries that would be required in the General Fund, unless told otherwise below. 1. Foster City issued bonds through its General Fund with a par value of $100,000,000. The bonds were dated and sold at par on January 1, 2021, and the bond proceeds went directly into the General Fund. The bonds mature on January 1, 2041, and have a stated annual interest rate of 4%. The interest is payable semi-annually, with a $$2,000,000 interest payment being due on June 30, 2021 and a $2,000,000 interest payment being due on December 31, 2021 for the first year. Bond principal of $5,000,000 will be paid each year for the next 20 years. The annual principal payments are due on December 31 of each year, with the first principal payment due on December 31, 2021. Required: At this time, record only the January 1,2021 issuance of the $100,000,000 regular serial bonds in the General Fund and Governmental Activities. Do not record anything else at this time. General Fund: Governmental Activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts