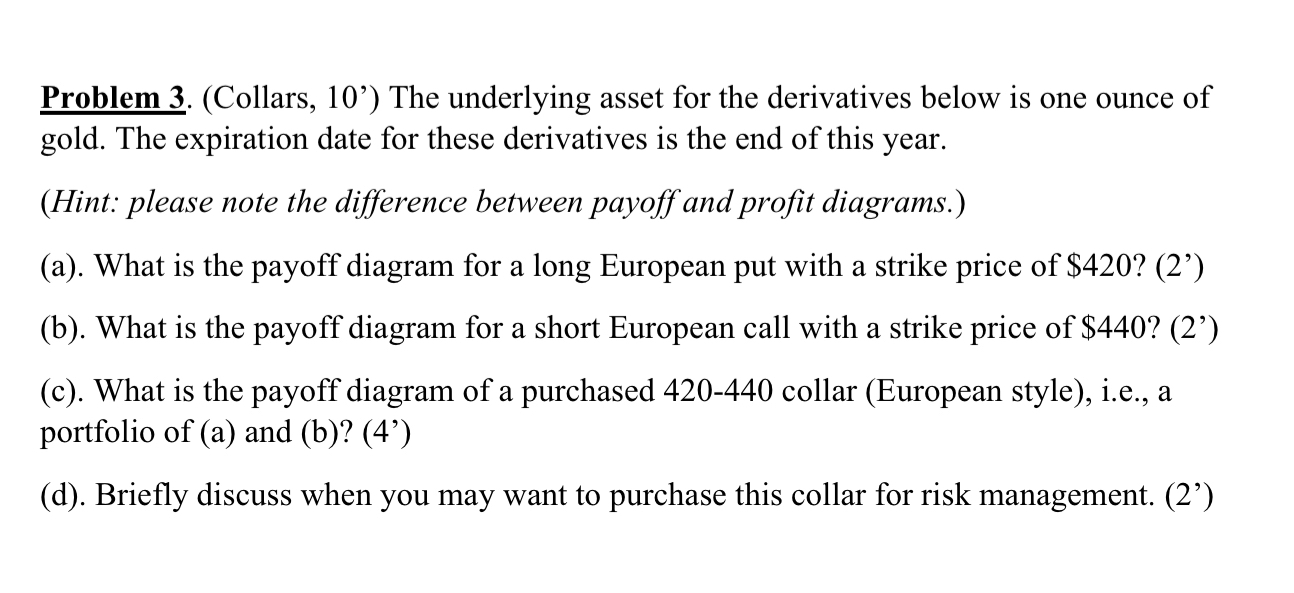

Question: Problem 3 . ( Collars , 1 0 ) The underlying asset for the derivatives below is one ounce of gold. The expiration date for

Problem Collars The underlying asset for the derivatives below is one ounce of gold. The expiration date for these derivatives is the end of this year. Hint: please note the difference between payoff and profit diagrams.a What is the payoff diagram for a long European put with a strike price of $b What is the payoff diagram for a short European call with a strike price of $c What is the payoff diagram of a purchased collar European style ie a portfolio of a and bd Briefly discuss when you may want to purchase this collar for risk management. Problem Collars The underlying asset for the derivatives below is one ounce of

gold. The expiration date for these derivatives is the end of this year.

Hint: please note the difference between payoff and profit diagrams.

a What is the payoff diagram for a long European put with a strike price of $

b What is the payoff diagram for a short European call with a strike price of $

c What is the payoff diagram of a purchased collar European style ie a

portfolio of a and b

d Briefly discuss when you may want to purchase this collar for risk management.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock