Question: Problem 3 . ( Commodity forwards, 1 0 ' ) Assume that the forward price of corn for delivery in exactly three months from today

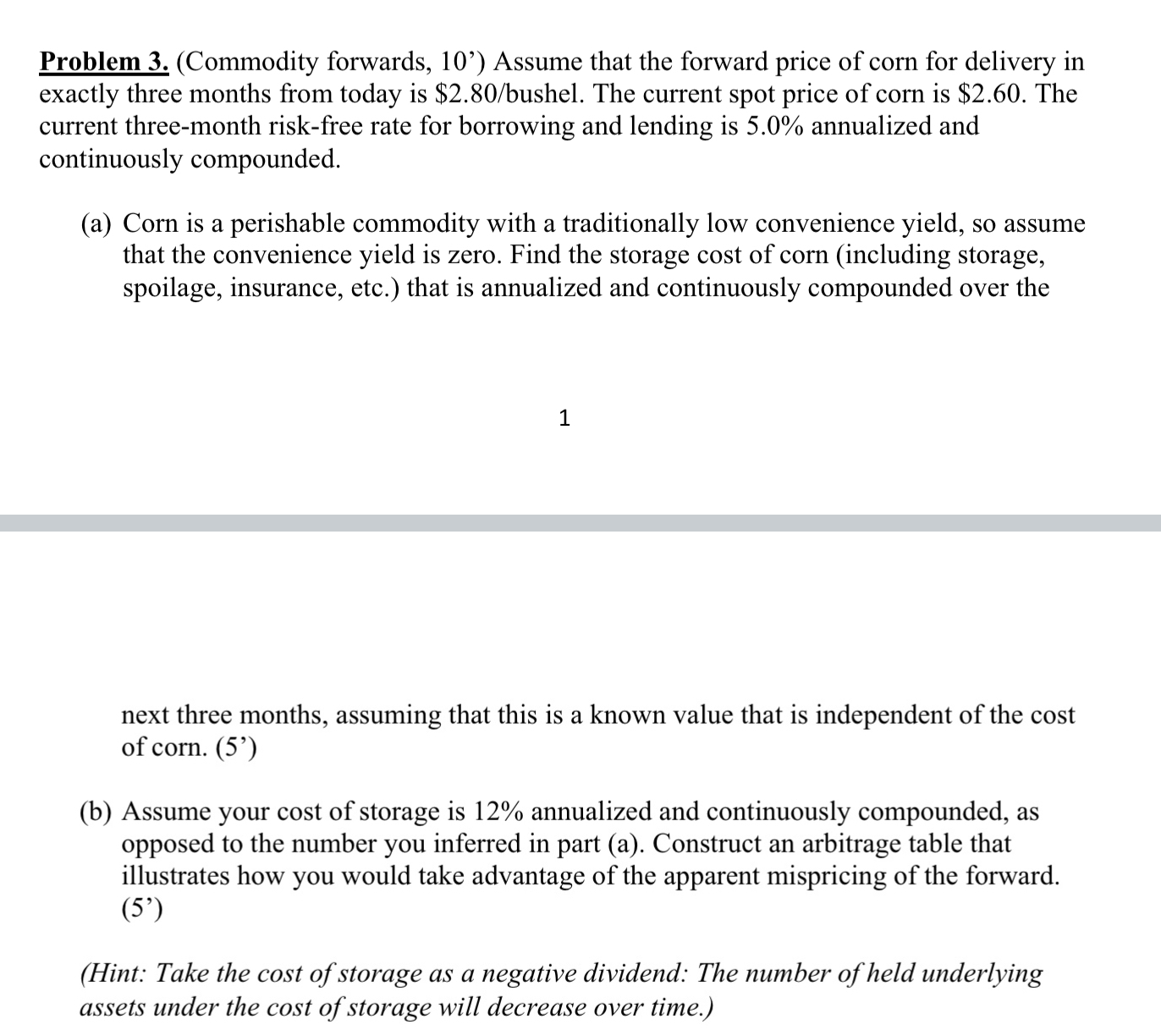

Problem Commodity forwards, Assume that the forward price of corn for delivery in exactly three months from today is $ bushel. The current spot price of corn is $ The current threemonth riskfree rate for borrowing and lending is annualized and continuously compounded.

a Corn is a perishable commodity with a traditionally low convenience yield, so assume that the convenience yield is zero. Find the storage cost of corn including storage, spoilage, insurance, etc. that is annualized and continuously compounded over the

next three months, assuming that this is a known value that is independent of the cost of corn.

b Assume your cost of storage is annualized and continuously compounded, as opposed to the number you inferred in part a Construct an arbitrage table that illustrates how you would take advantage of the apparent mispricing of the forward.

Hint: Take the cost of storage as a negative dividend: The number of held underlying assets under the cost of storage will decrease over time.

Is the answer of a Also, can you build me the arbitrage table in part b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock