Question: Problem 3 Consider a derivative that pays off si at time T, where St is the stock price at time T. When the stock price

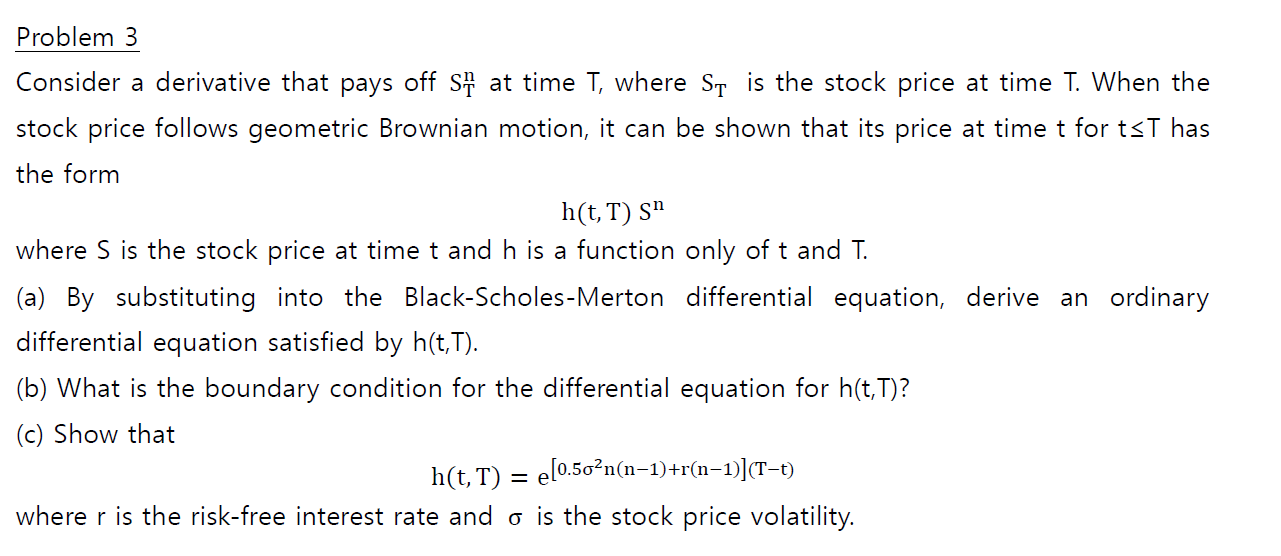

Problem 3 Consider a derivative that pays off si at time T, where St is the stock price at time T. When the stock price follows geometric Brownian motion, it can be shown that its price at time t for tst has the form h(t, T) S" where S is the stock price at time t and h is a function only of t and T. (a) By substituting into the Black-Scholes-Merton differential equation, derive an ordinary differential equation satisfied by h(t,T). (b) What is the boundary condition for the differential equation for h(t,T)? (c) Show that h(t, T) = e[0.50_n(n-1)+r(n-1)](T-t) where r is the risk-free interest rate and o is the stock price volatility. = Problem 3 Consider a derivative that pays off si at time T, where St is the stock price at time T. When the stock price follows geometric Brownian motion, it can be shown that its price at time t for tst has the form h(t, T) S" where S is the stock price at time t and h is a function only of t and T. (a) By substituting into the Black-Scholes-Merton differential equation, derive an ordinary differential equation satisfied by h(t,T). (b) What is the boundary condition for the differential equation for h(t,T)? (c) Show that h(t, T) = e[0.50_n(n-1)+r(n-1)](T-t) where r is the risk-free interest rate and o is the stock price volatility. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts