Question: Problem 3: Consider the assets in problem 1 with their respective beta coefficients to answer the following questions: to. Which of the assets represents the

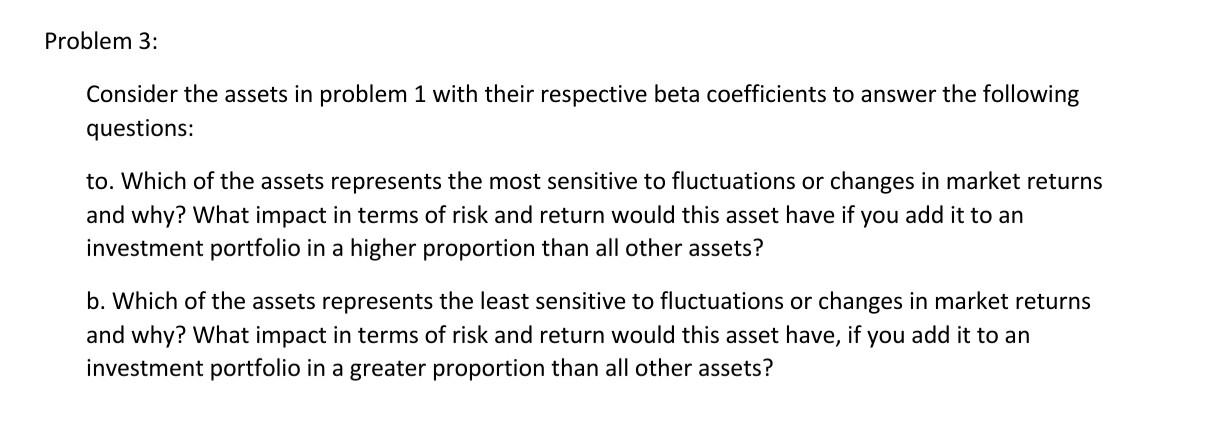

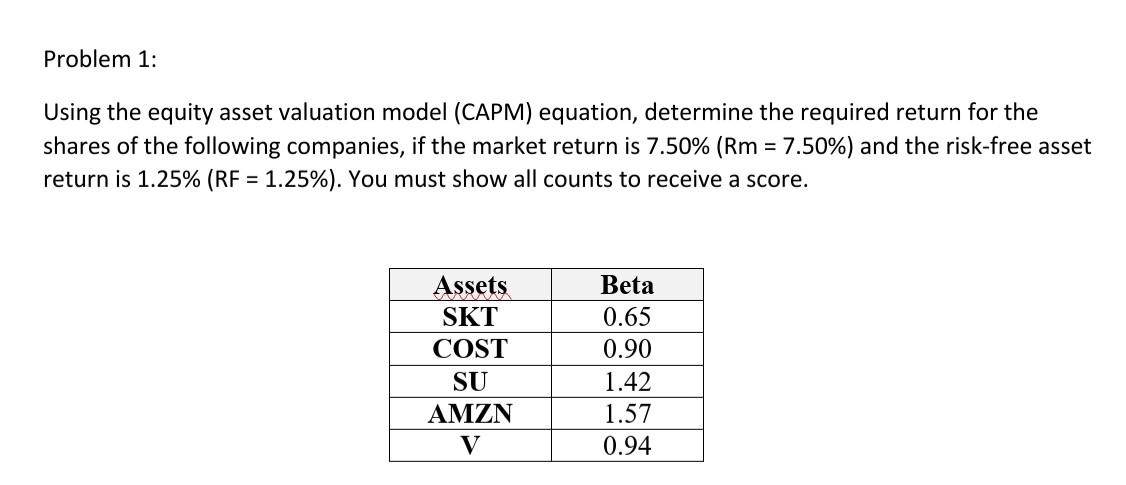

Problem 3: Consider the assets in problem 1 with their respective beta coefficients to answer the following questions: to. Which of the assets represents the most sensitive to fluctuations or changes in market returns and why? What impact in terms of risk and return would this asset have if you add it to an investment portfolio in a higher proportion than all other assets? b. Which of the assets represents the least sensitive to fluctuations or changes in market returns and why? What impact in terms of risk and return would this asset have, if you add it to an investment portfolio in a greater proportion than all other assets? Problem 1: Using the equity asset valuation model (CAPM) equation, determine the required return for the shares of the following companies, if the market return is 7.50% (Rm = 7.50%) and the risk-free asset return is 1.25% (RF = 1.25%). You must show all counts to receive a score. Assets SKT COST SU AMZN V Beta 0.65 0.90 1.42 1.57 0.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts