Question: Problem 3. David borrows an amount at an annual effective interest rate of 7.25% and will repay all interest and principal in a lump sum

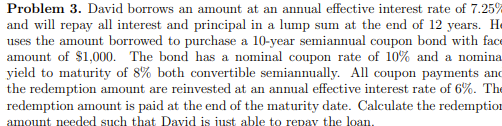

Problem 3. David borrows an amount at an annual effective interest rate of 7.25% and will repay all interest and principal in a lump sum at the end of 12 years. H uses the amount borrowed to purchase a 10-year semiannual coupon bond with fac amount of $1,000. The bond has a nominal coupon rate of 10% and a nomina yield to maturity of 8% both convertible semiannually. All coupon payments and the redemption amount are reinvested at an annual effective interest rate of 6%. Th redemption amount is paid at the end of the maturity date. Calculate the redemptiot amount needed such that David is iust able to repay the loan. Problem 3. David borrows an amount at an annual effective interest rate of 7.25% and will repay all interest and principal in a lump sum at the end of 12 years. H uses the amount borrowed to purchase a 10-year semiannual coupon bond with fac amount of $1,000. The bond has a nominal coupon rate of 10% and a nomina yield to maturity of 8% both convertible semiannually. All coupon payments and the redemption amount are reinvested at an annual effective interest rate of 6%. Th redemption amount is paid at the end of the maturity date. Calculate the redemptiot amount needed such that David is iust able to repay the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts