Question: Problem 3: Derivatives Valuation (6 marks) A stock price is currently $36. During each three-month period for the next six months it is expected to

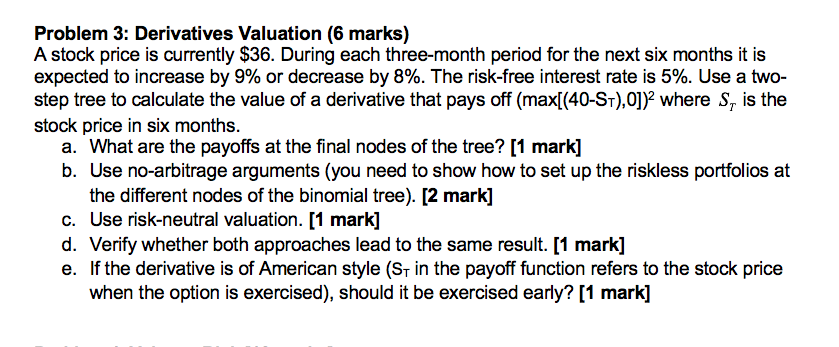

Problem 3: Derivatives Valuation (6 marks) A stock price is currently $36. During each three-month period for the next six months it is expected to increase by 9% or decrease by 8%. The risk-free interest rate is 5%. Use a two- step tree to calculate the value of a derivative that pays off (max[(40-ST), 0])2 where S, is the stock price in six months. a. What are the payoffs at the final nodes of the tree? [1 mark] b. Use no-arbitrage arguments (you need to show how to set up the riskless portfolios at the different nodes of the binomial tree). [2 mark] c. Use risk-neutral valuation. [1 mark] d. Verify whether both approaches lead to the same result. [1 mark] e. If the derivative is of American style (St in the payoff function refers to the stock price when the option is exercised), should it be exercised early? [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts