Question: Problem 3 : Estimate the most current Weighted Average Cost of Capital of Harley Davidson Inc ( ticker: HOG; CUSIP: 4 1 2 8 2

Problem :

Estimate the most current Weighted Average Cost of Capital of Harley Davidson Inc ticker: HOG; CUSIP: Use CAPM to estimate the cost of equity. Assume that the capital structure the market debttoequity ratio observed as of the most recent annual financial statements remains in place forever for the company. Also assume that the market risk premium is and that the marginal tax rate is

Recipe:

a Calculate the cost of debt using most recent yields from a representative set of Harley Davidson public bonds.

b Calculate the market value of Harley Davidson debt using book value of debt adjusted by the price to face value multiple of a set of public bonds of Harley Davidson.

c The marginal tax rate is provided.

d Calculate the market value of equity using number of shares outstanding from the most recent financial report and historical stock price as of that date from NYSE, NASDAQ or Yahoo.

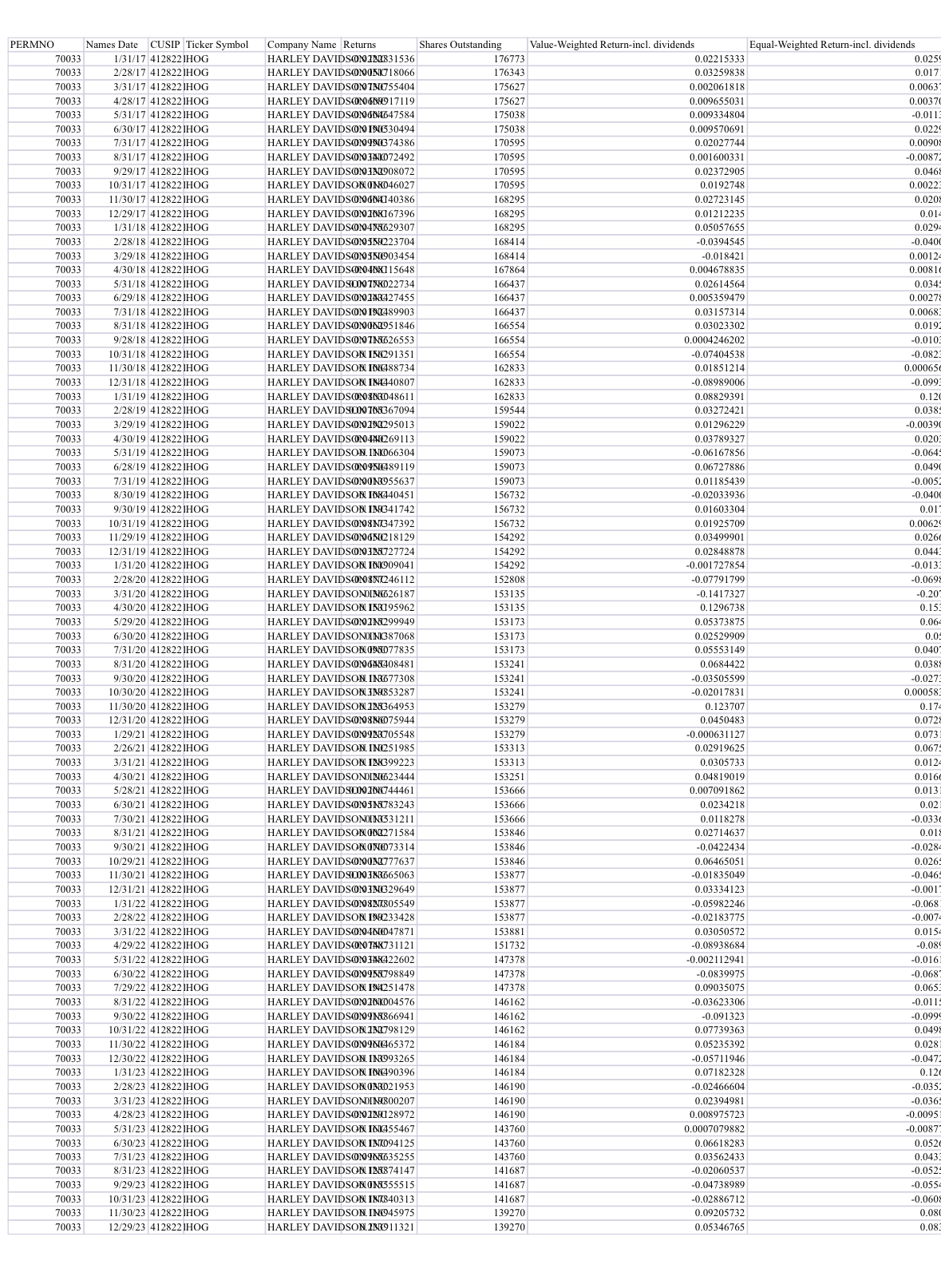

e Calculate the cost of equity using CAPM. For that, you are provided the market risk premium. Use current yield on the year Treasury bond as the riskfree rate, and calculate the beta of Harley Davidson stock using years that is months of monthly stock returns and valueweighted VW CRSP portfolio as the market portfolio. Data on stock returns are provided in the Excel file obtained from the CRSP database column contains the monthly returns of Harley Davidson stock, column H contains monthly returns of the valueweighted CRSP portfolio of stocks, column J contains monthly returns of the S&P portfolio of stocks

f Combine it all to calculate Weighted Average Cost of Capital WACC for Harley Davidson.

Suggested sources of the data:

SEC's Edgar database for financial statements and annual or quarterly report K or

Stock returns from CRSP database to calculate the beta.

FINRA's TRACE database for public bond yields and prices

US Treasury's website for Tbond rates

Yahoo's finance website,

NYSE.com or

NASDAQ.com for the stock price around the date of the most recent financial report.

To get to financial statements:

search Google for "sec edgar company filings"

in Company Lookup, search by the company name or ticket

select and reports view all and

select "filing" of the respective report

select "interactive data" tab

"financial statements" tab takes you to Statements of Income Income Statement and Balance Sheets

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock