Question: Problem 3. Executive Stock Options (Spreadsheet Programming) Part of controversial issues around expensing the employee compensation stock options is the valuation. Neither the accounting approach,

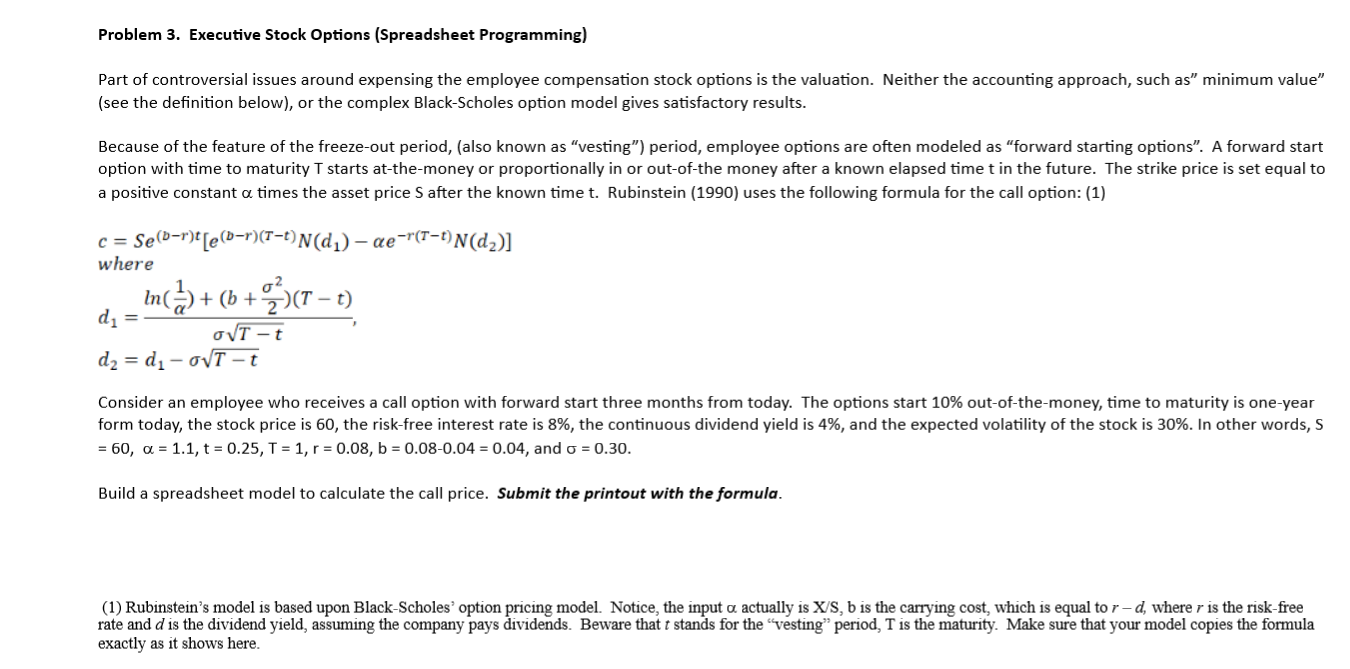

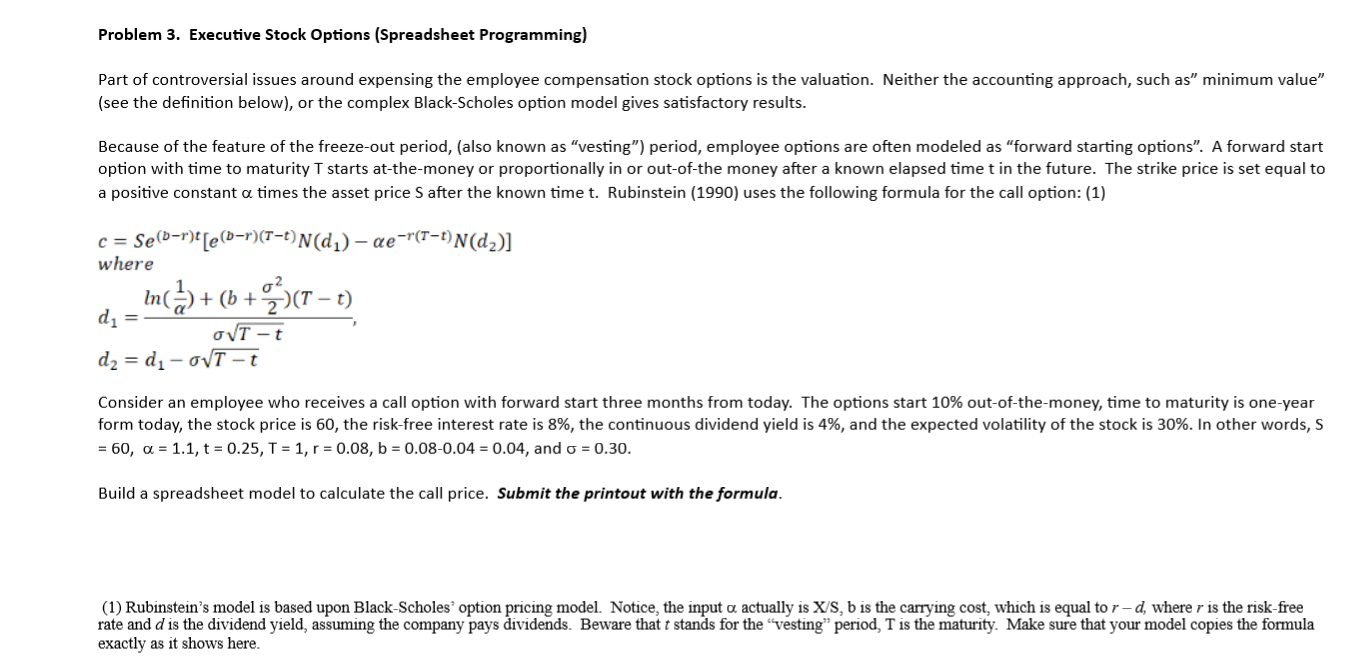

Problem 3. Executive Stock Options (Spreadsheet Programming) Part of controversial issues around expensing the employee compensation stock options is the valuation. Neither the accounting approach, such as" minimum value" (see the definition below), or the complex Black-Scholes option model gives satisfactory results. Because of the feature of the freeze-out period, (also known as "vesting") period, employee options are often modeled as "forward starting options". A forward start option with time to maturity T starts at-the-money or proportionally in or out-of-the money after a known elapsed time t in the future. The strike price is set equal to a positive constant o times the asset price S after the known time t. Rubinstein (1990) uses the following formula for the call option: (1) c = Se(b-r)t[e(D-r)(T-t)N(dj) - aer(T-D)N(d2)] where d1 = In( 2 ) + (b + 02 + 2 ) ( T - t ) OVT -t d2 = 1 - ovT-t Consider an employee who receives a call option with forward start three months from today. The options start 10% out-of-the-money, time to maturity is one-year form today, the stock price is 60, the risk-free interest rate is 8%, the continuous dividend yield is 4%, and the expected volatility of the stock is 30%. In other words, S = 60, o = 1.1, t = 0.25, T = 1, r = 0.08, b = 0.08-0.04 = 0.04, and o = 0.30. Build a spreadsheet model to calculate the call price. Submit the printout with the formula. (1) Rubinstein's model is based upon Black-Scholes' option pricing model. Notice, the input a actually is X/S, b is the carrying cost, which is equal to r -d, where r is the risk-free rate and d is the dividend yield, assuming the company pays dividends. Beware that : stands for the "vesting" period, T is the maturity. Make sure that your model copies the formula exactly as it shows here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts