Question: Problem 3: Given the following MACRS depreciation schedule on the next page, calculate annual depreciation of a capital investment of $360,000 and the tax shield

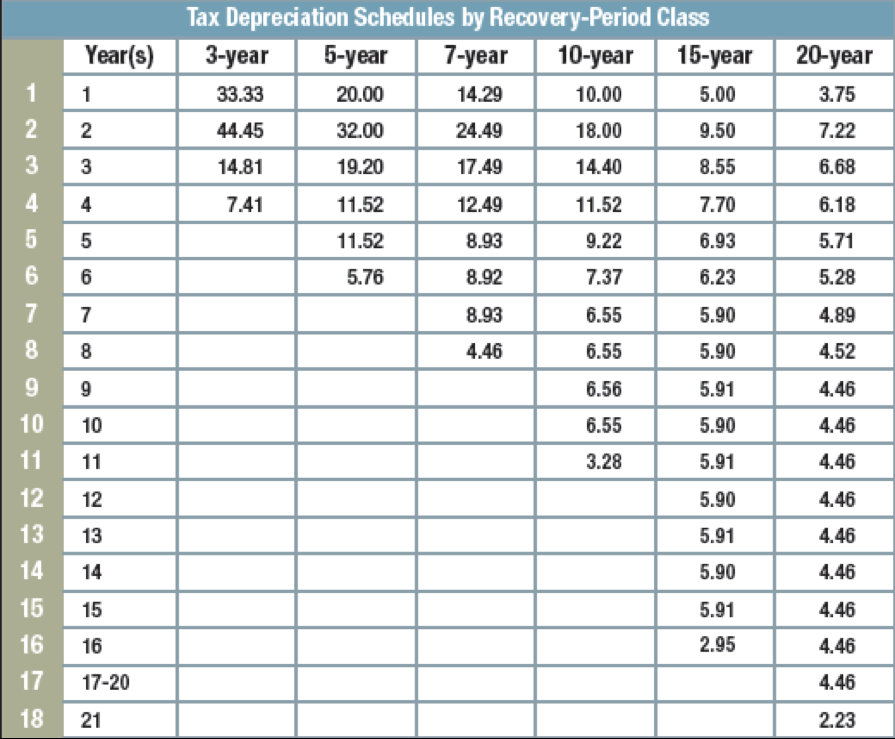

Problem 3: Given the following MACRS depreciation schedule on the next page, calculate annual depreciation of a capital investment of $360,000 and the tax shield each year with tax rate of 34% based on a 3 year MACRS percentages.

Tax Depreciation Schedules by Recovery-Period Class Year(s)3-yea5-year7-year10-year 15-year 20-year 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 3.75 7.22 6.68 6.18 5.71 5.28 4.89 4.52 4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46 2.23 2 9 10 12 12 13 14 15 16 17-20 21 14 16 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts