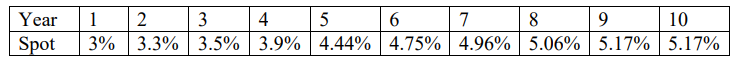

Question: Problem 3. Given the spot rates in the following table. a) Compute the implied one year future interest rate (from year t to year t+1)

Problem 3. Given the spot rates in the following table.

a) Compute the implied one year future interest rate (from year t to year t+1)

b) Compute the value of a 4.8% 10-Year Annual Coupon Bond using i) the spot rate, and ii) le future rate

c) Determine the YTM using the value found in b) as a proxy market price

\begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|} \hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 \\ \hline Spot & 3% & 3.3% & 3.5% & 3.9% & 4.44% & 4.75% & 4.96% & 5.06% & 5.17% & 5.17% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock