Question: Problem 3 (Hedging) Suppose a U.S exporter to Germany knows today that he will be receiving 100,000 at the end of 6 months from today.

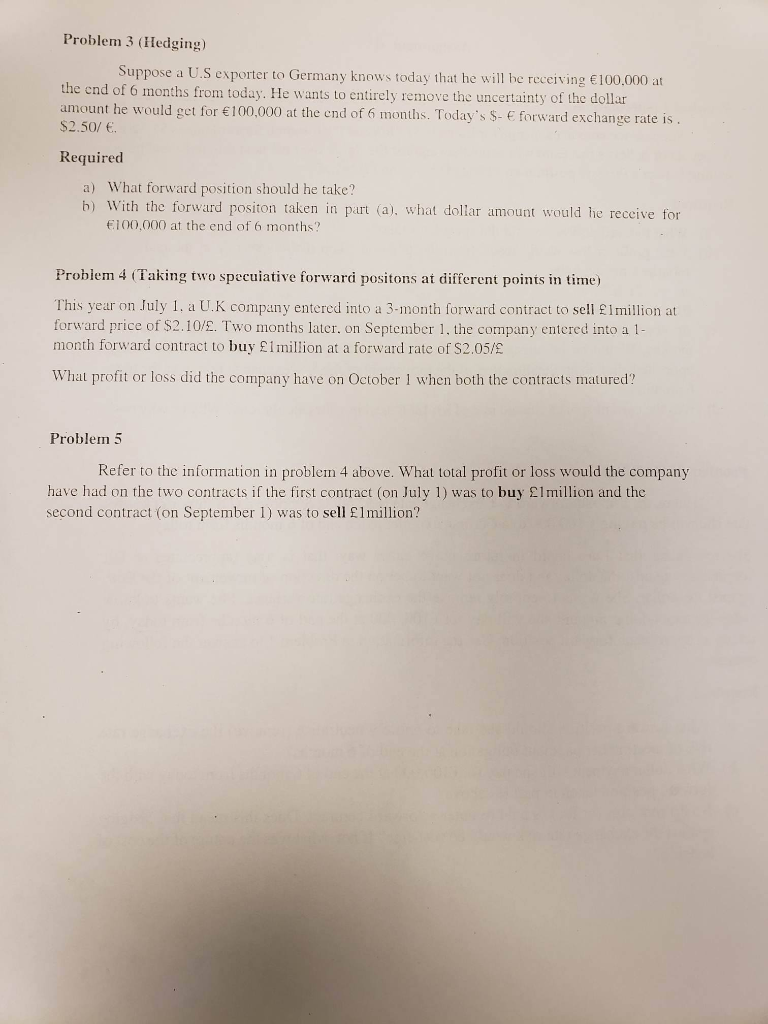

Problem 3 (Hedging) Suppose a U.S exporter to Germany knows today that he will be receiving 100,000 at the end of 6 months from today. He wants to entirely remove the uncertainty of the dollar amount he would get for 100,000 at the end of 6 months. Today's $- forward exchange rate is. $2.50/ . Required a) What forward position should he take? b) With the forward positon taken in part (a), what dollar amount would he receive for 100,000 at the end of 6 months? Problem 4 (Taking two specuiative forward positons at different points in time) This year on July 1. a U.K company entered into a 3-month forward contract to sell lmillion at forward price of $2.10/E. Two months later. on September 1, the company entered into a 1- month forward contract to buy 1million at a forward rate of $2.05/ What profit or loss did the company have on October 1 when both the contracts matured? Problem 5 Refer to the information in problem 4 above. What total profit or loss would the company have had on the two contracts if the first contract (on July 1) was to buy lmillion and the second contract (on September 1) was to sell lmillion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts