Question: Problem 3. In class, we learned the Fisher Hypothesis: 'real = rnom + E) It states that the real interest rate is the nominal interest

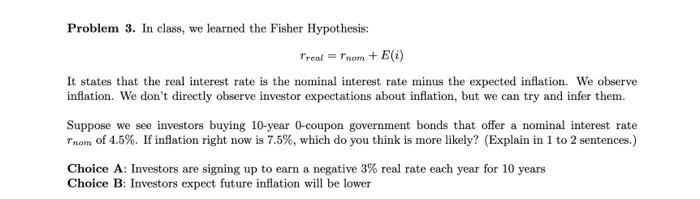

Problem 3. In class, we learned the Fisher Hypothesis: 'real = rnom + E) It states that the real interest rate is the nominal interest rate minus the expected inflation. We observe inflation. We don't directly observe investor expectations about inflation, but we can try and infer them. Suppose we see investors buying 10-year O-coupon government bonds that offer a nominal interest rate Inom of 4.5%. If inflation right now is 7.5%, which do you think is more likely? (Explain in 1 to 2 sentences.) Choice A: Investors are signing up to earn a negative 3% real rate each year for 10 years Choice B: Investors expect future inflation will be lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts