Question: Problem 3 Intro Cargill is a U.S. firms producing cattle feed. It imports soy beans from Brazil and also sell some products there. The company

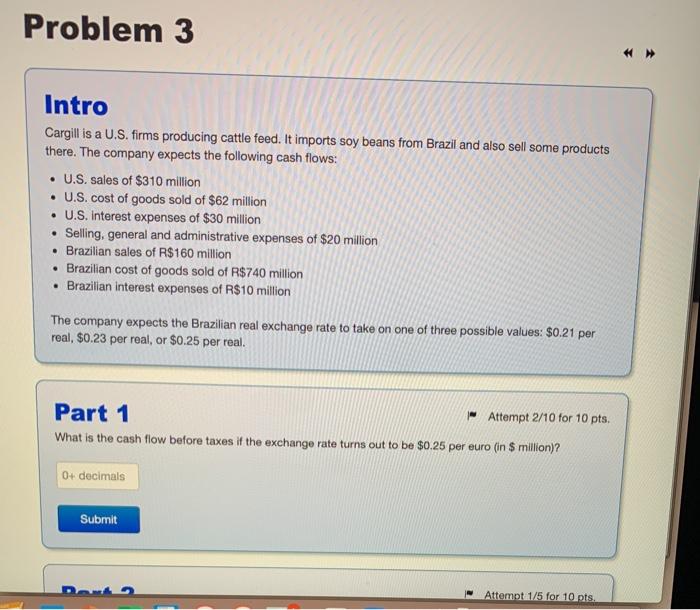

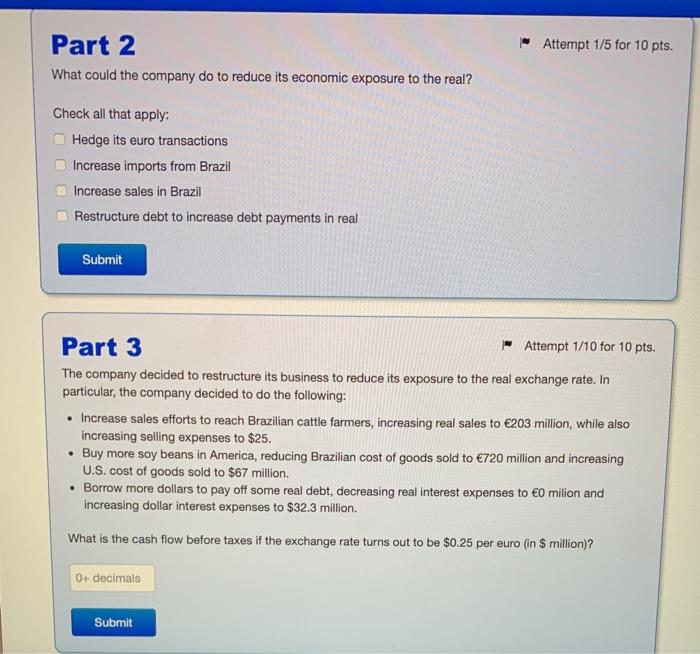

Problem 3 Intro Cargill is a U.S. firms producing cattle feed. It imports soy beans from Brazil and also sell some products there. The company expects the following cash flows: U.S. sales of $310 million U.S. cost of goods sold of $62 million U.S. Interest expenses of $30 million Selling, general and administrative expenses of $20 million Brazilian sales of R$160 million Brazilian cost of goods sold of R$740 million Brazilian interest expenses of R$10 million . The company expects the Brazilian real exchange rate to take on one of three possible values: $0.21 per real, $0.23 per real, or $0.25 per real. Part 1 - Attempt 2/10 for 10 pts. What is the cash flow before taxes if the exchange rate turns out to be $0.25 per euro (in $ million)? 0+ decimals Submit Attempt 1/5 for 10 pts Attempt 1/5 for 10 pts. Part 2 What could the company do to reduce its economic exposure to the real? Check all that apply: Hedge its euro transactions Increase imports from Brazil Increase sales in Brazil Restructure debt to increase debt payments in real Submit Part 3 Attempt 1/10 for 10 pts. The company decided to restructure its business to reduce its exposure to the real exchange rate. In particular, the company decided to do the following: Increase sales efforts to reach Brazilian cattle farmers, increasing real sales to 203 million, while also increasing selling expenses to $25. Buy more soy beans in America, reducing Brazilian cost of goods sold to 720 million and increasing U.S. cost of goods sold to $67 million. Borrow more dollars to pay off some real debt, decreasing real interest expenses to 0 milion and increasing dollar interest expenses to $32.3 million. What is the cash flow before taxes if the exchange rate turns out to be $0.25 per euro (in 9 million)? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts