Question: Problem 3 Intro Munich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a

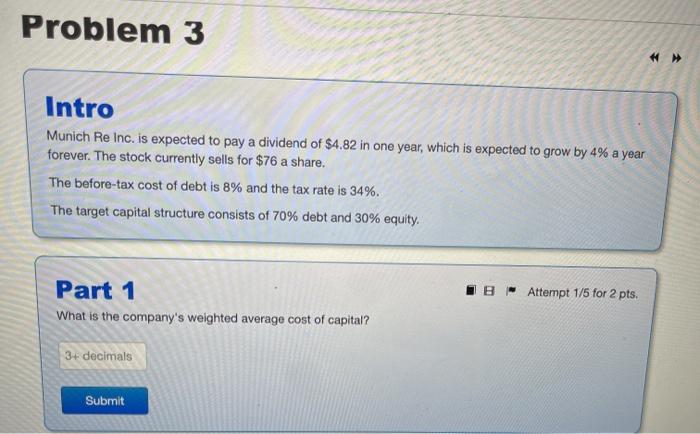

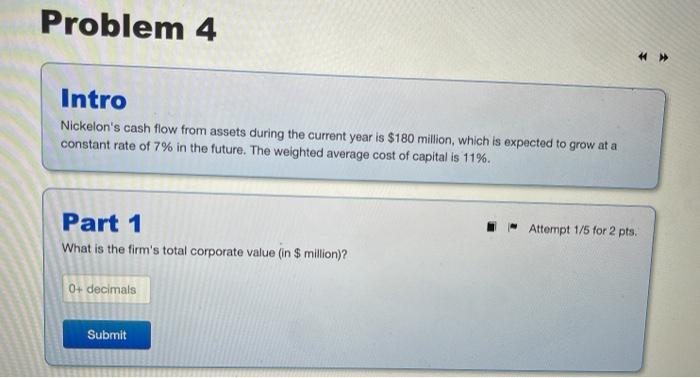

Problem 3 Intro Munich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a year forever. The stock currently sells for $76 a share. The before-tax cost of debt is 8% and the tax rate is 34%. The target capital structure consists of 70% debt and 30% equity. B-Attempt 1/5 for 2 pts. Part 1 What is the company's weighted average cost of capital? 3+ decimals Submit Problem 4 Intro Nickelon's cash flow from assets during the current year is $180 million, which is expected to grow at a constant rate of 7% in the future. The weighted average cost of capital is 11%. Part 1 What is the firm's total corporate value (in $ million)? Attempt 1/5 for 2 pts. 0+ decimals Submit Problem 3 Intro Munich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a year forever. The stock currently sells for $76 a share. The before-tax cost of debt is 8% and the tax rate is 34%. The target capital structure consists of 70% debt and 30% equity. B-Attempt 1/5 for 2 pts. Part 1 What is the company's weighted average cost of capital? 3+ decimals Submit Problem 4 Intro Nickelon's cash flow from assets during the current year is $180 million, which is expected to grow at a constant rate of 7% in the future. The weighted average cost of capital is 11%. Part 1 What is the firm's total corporate value (in $ million)? Attempt 1/5 for 2 pts. 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts