Question: Problem 3: Last Call You receive an order from a customer just before the fiscal year ends. The sale is for 100,000$ and you will

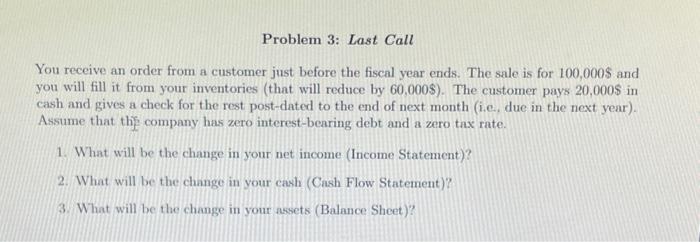

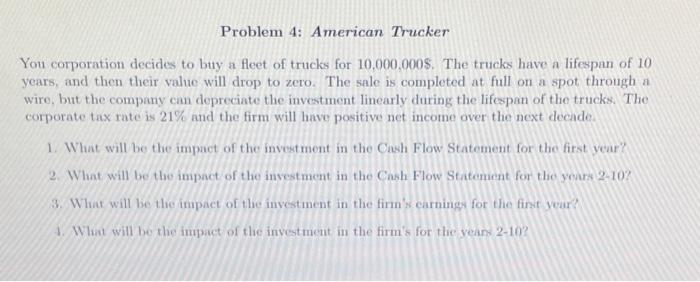

Problem 3: Last Call You receive an order from a customer just before the fiscal year ends. The sale is for 100,000$ and you will fill it from your inventories (that will reduce by 60,000$ ). The customer pays 20,000$ in cash and gives a check for the rest post-dated to the end of next month (i.e., due in the next year). Assume that the company has zero interest-bearing debt and a zero tax rate. 1. What will be the change in your net income (Income Statement)? 2. What will be the change in your cash (Cash Flow Statement)? 3. What will be the change in your assets (Balance Sheet)? Problem 4: American Trucker You corporation decides to buy a fleet of trucks for 10,000,000$. The trucks have a lifespan of 10 years, and then their value will drop to zero. The sale is completed at full on a spot through a wire, but the company can depreciate the investment linearly during the lifespan of the trucks. The corporate tax rate is 21% and the firm will have positive net income over the next decade. 1. What will be the impact of the investment in the Cash Flow Statement for the first year? 2. What will be the impact of the investment in the Cash Flow Statement for the yours 2-10? 3. What will be the impact of the investment in the firm's carnings for the first year? 4. What will be the impact of the investment in the firm's for the yean 2-10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts