Question: Problem 3 Let's Play A firm evaluates 4 investment projects with cash flows as provided in the table below. The required rate of return

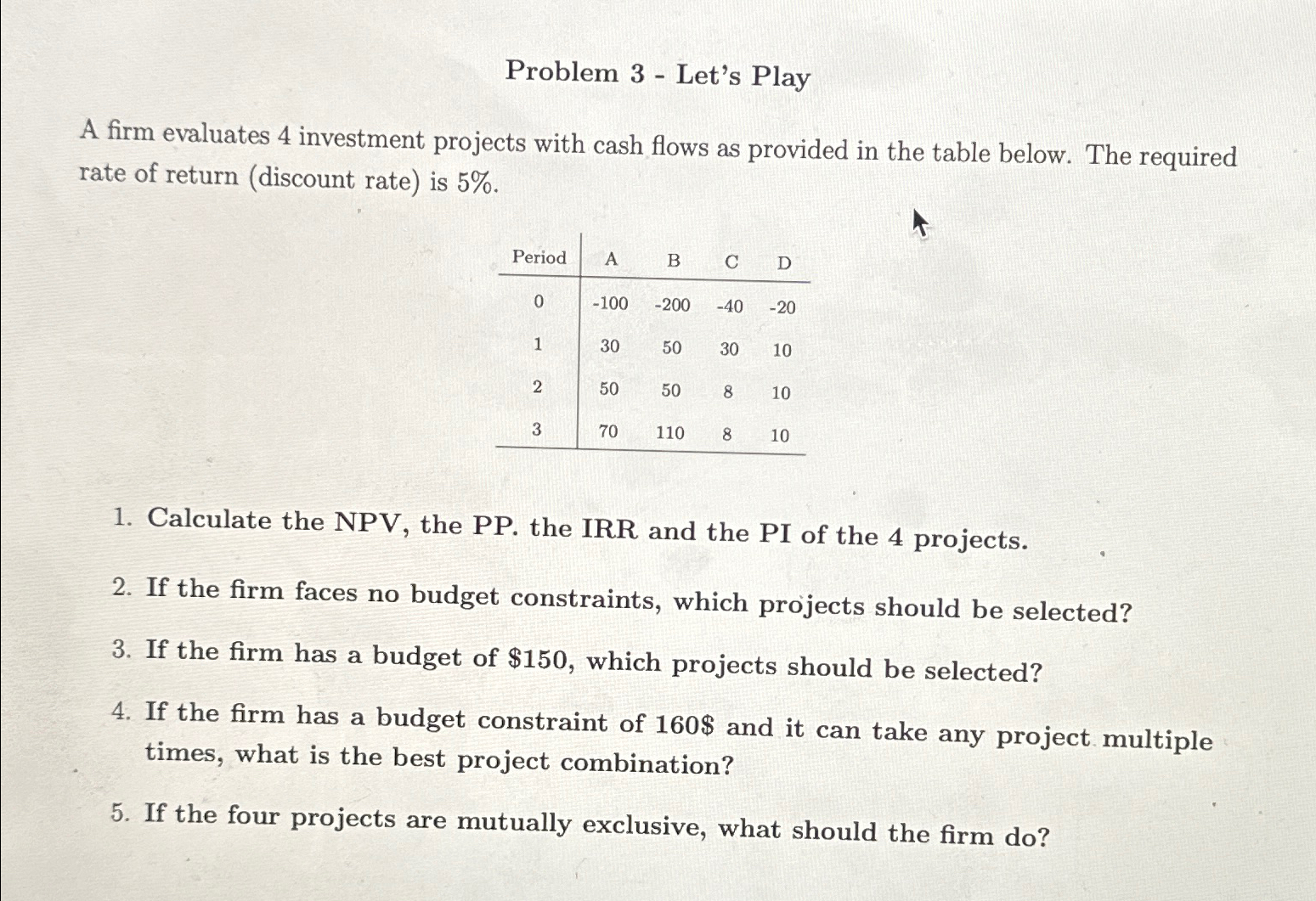

Problem 3 Let's Play A firm evaluates 4 investment projects with cash flows as provided in the table below. The required rate of return (discount rate) is 5%. Period A B C D 0 -100 -200 -40 -20 1 30 50 50 30 10 2 50 50 8 10 3 70 110 8 10 1. Calculate the NPV, the PP. the IRR and the PI of the 4 projects. 2. If the firm faces no budget constraints, which projects should be selected? 3. If the firm has a budget of $150, which projects should be selected? 4. If the firm has a budget constraint of 160$ and it can take any project multiple times, what is the best project combination? 5. If the four projects are mutually exclusive, what should the firm do?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts