Question: Problem 3: Long-term liabilities TR Corp. issued callable bonds with a face value of $12,000,000 and a stated interest (coupon) rate of 11%. The bonds

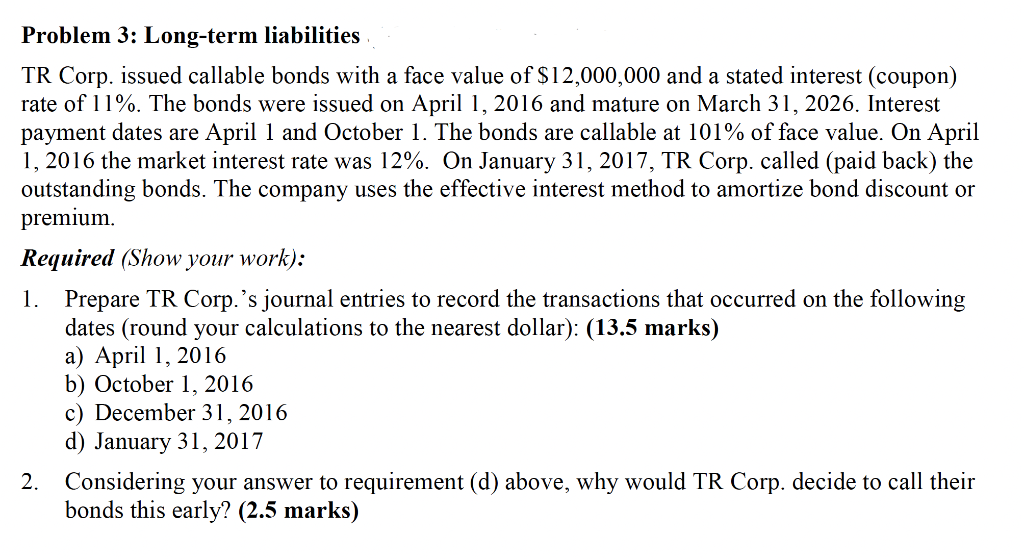

Problem 3: Long-term liabilities TR Corp. issued callable bonds with a face value of $12,000,000 and a stated interest (coupon) rate of 11%. The bonds were issued on April 1, 2016 and mature on March 31, 2026. Interest payment dates are April 1 and October 1 . The bonds are callable at 101% of face value. On April 1, 2016 the market interest rate was 12\%. On January 31, 2017, TR Corp. called (paid back) the outstanding bonds. The company uses the effective interest method to amortize bond discount or premium. Required (Show your work): 1. Prepare TR Corp.'s journal entries to record the transactions that occurred on the following dates (round your calculations to the nearest dollar): (13.5 marks) a) April 1, 2016 b) October 1, 2016 c) December 31,2016 d) January 31, 2017 2. Considering your answer to requirement (d) above, why would TR Corp. decide to call their bonds this early? (2.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts