Question: PROBLEM 3 MBC Construction, is a real estate developer is currently developing a 2-tower residential condominium. Tower one will have 20 residential units while tower

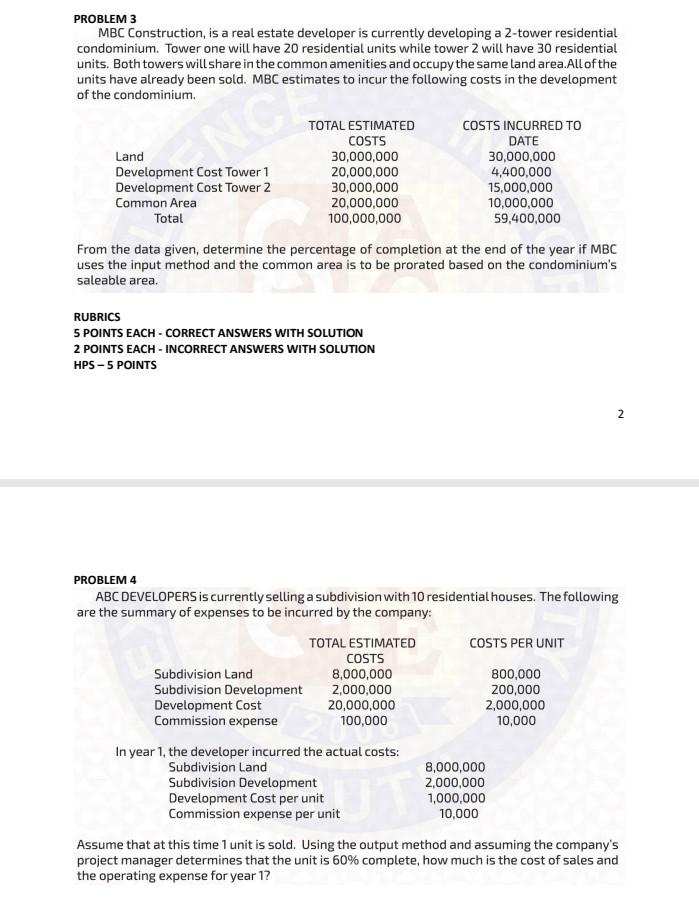

PROBLEM 3 MBC Construction, is a real estate developer is currently developing a 2-tower residential condominium. Tower one will have 20 residential units while tower 2 will have 30 residential units. Both towers will share in the common amenities and occupy the same land area.All of the units have already been sold. MBC estimates to incur the following costs in the development of the condominium TOTAL ESTIMATED COSTS INCURRED TO COSTS DATE Land 30,000,000 30,000,000 Development Cost Tower 1 20,000,000 4,400,000 Development Cost Tower 2 30,000,000 15,000,000 Common Area 20,000,000 10,000,000 Total 100,000,000 59,400,000 From the data given, determine the percentage of completion at the end of the year if MBC uses the input method and the common area is to be prorated based on the condominium's saleable area. NO RUBRICS 5 POINTS EACH - CORRECT ANSWERS WITH SOLUTION 2 POINTS EACH - INCORRECT ANSWERS WITH SOLUTION HPS - 5 POINTS 2 PROBLEM 4 ABC DEVELOPERS is currently selling a subdivision with 10 residential houses. The following are the summary of expenses to be incurred by the company: TOTAL ESTIMATED COSTS PER UNIT COSTS Subdivision Land 8,000,000 800,000 Subdivision Development 2,000,000 200,000 Development Cost 20,000,000 2,000,000 Commission expense 100,000 10,000 In year 1, the developer incurred the actual costs: Subdivision Land 8,000,000 Subdivision Development 2,000,000 Development Cost per unit 1,000,000 Commission expense per unit 10,000 Assume that at this time 1 unit is sold. Using the output method and assuming the company's project manager determines that the unit is 60% complete, how much is the cost of sales and the operating expense for year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts