Question: Problem #3 Multiple Temporary Differences First Capital Company had the following temporary differences on their financial statements and tax return during 2023: - Warranty expense

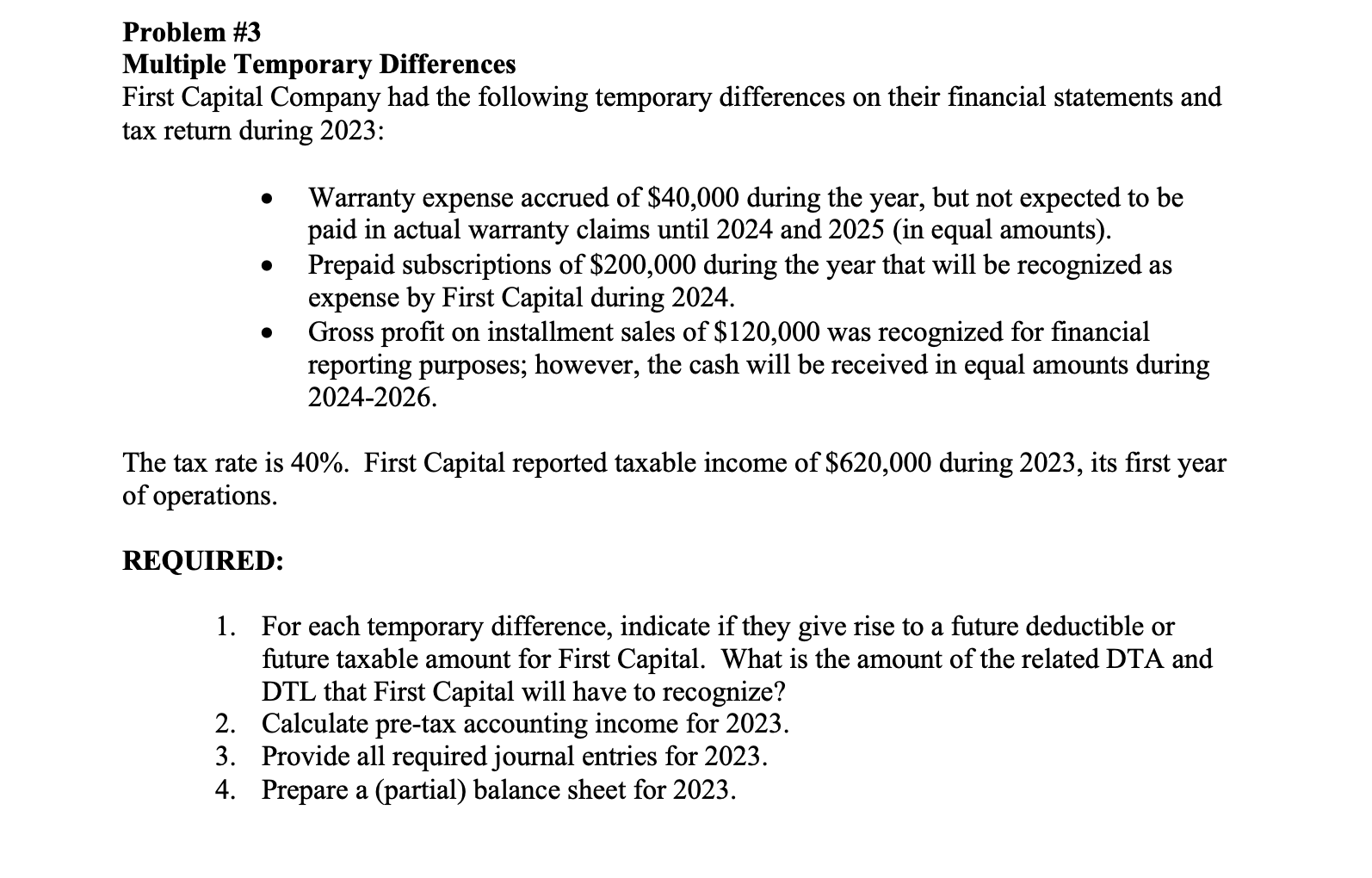

Problem \#3 Multiple Temporary Differences First Capital Company had the following temporary differences on their financial statements and tax return during 2023: - Warranty expense accrued of $40,000 during the year, but not expected to be paid in actual warranty claims until 2024 and 2025 (in equal amounts). - Prepaid subscriptions of $200,000 during the year that will be recognized as expense by First Capital during 2024. - Gross profit on installment sales of $120,000 was recognized for financial reporting purposes; however, the cash will be received in equal amounts during 2024-2026. The tax rate is 40%. First Capital reported taxable income of $620,000 during 2023, its first year of operations. REQUIRED: 1. For each temporary difference, indicate if they give rise to a future deductible or future taxable amount for First Capital. What is the amount of the related DTA and DTL that First Capital will have to recognize? 2. Calculate pre-tax accounting income for 2023. 3. Provide all required journal entries for 2023. 4. Prepare a (partial) balance sheet for 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts