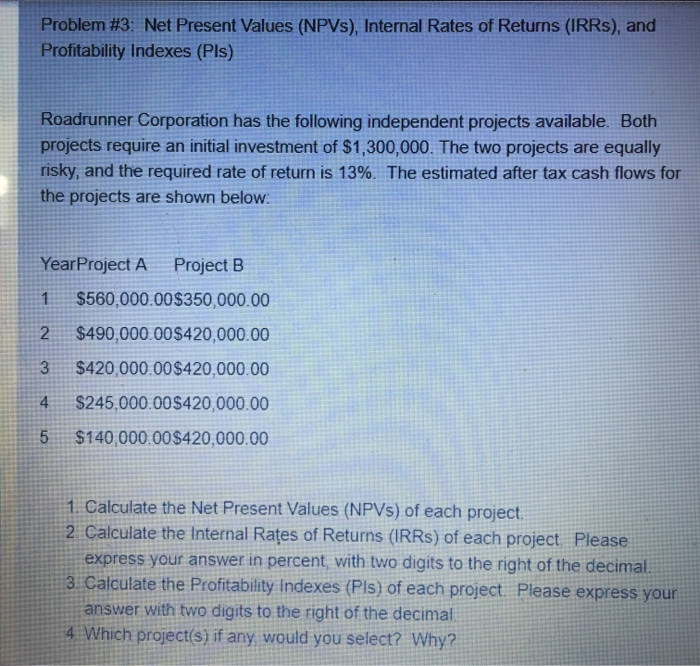

Question: Problem #3: Net Present Values (NPVs), Internal Rates of Returns (IRRs), and Profitability Indexes (Pls) Roadrunner Corporation has the following independent projects available. Both projects

Problem #3: Net Present Values (NPVs), Internal Rates of Returns (IRRs), and Profitability Indexes (Pls) Roadrunner Corporation has the following independent projects available. Both projects require an initial investment of $1,300,000. The two projects are equally risky, and the required rate of return is 13%. The estimated after tax cash flows for the projects are shown below: Year Project A Project B $560,000.00$350,000.00 2 $490,000.00$420,000.00 3 $420,000.00$420,000.00 $245,000.00$420,000.00 5 $140,000.00$420,000.00 1. Calculate the Net Present Values (NPVs) of each project 2. Calculate the Internal Rates of Returns (IRRs) of each project. Please express your answer in percent with two digits to the right of the decimal. 3. Calculate the Profitability Indexes (Pls) of each project. Please express your answer with two digits to the right of the decimal 4. Which project(s) if any, would you select? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts