Question: Problem 3: Net Tax Due(Refunded) Ted Higgins is a single taxpayer with an AGI of $160,000, taxable income of $100,000 and a calculated tax liability

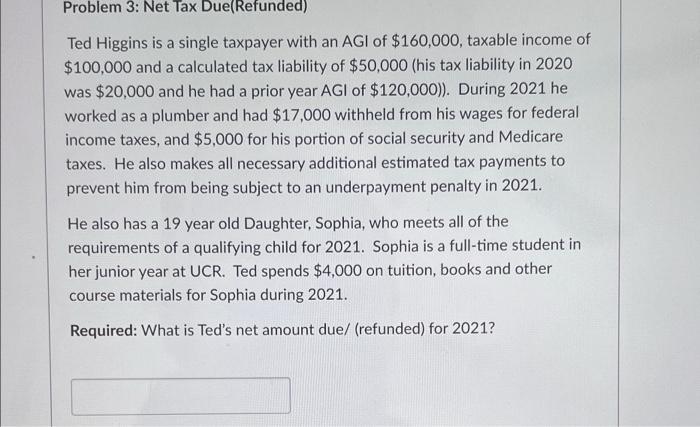

Problem 3: Net Tax Due(Refunded) Ted Higgins is a single taxpayer with an AGI of $160,000, taxable income of $100,000 and a calculated tax liability of $50,000 (his tax liability in 2020 was $20,000 and he had a prior year AGI of $120,000)). During 2021 he worked as a plumber and had $17,000 withheld from his wages for federal income taxes, and $5,000 for his portion of social security and Medicare taxes. He also makes all necessary additional estimated tax payments to prevent him from being subject to an underpayment penalty in 2021. He also has a 19 year old Daughter, Sophia, who meets all of the requirements of a qualifying child for 2021. Sophia is a full-time student in her junior year at UCR. Ted spends $4,000 on tuition, books and other course materials for Sophia during 2021. Required: What is Ted's net amount due/ (refunded) for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts