Question: PROBLEM 3 On Dec 31, 2018, Malton Corporation signed a five-year noncancelable lease The torms of the lease called for Malton to make annual payments

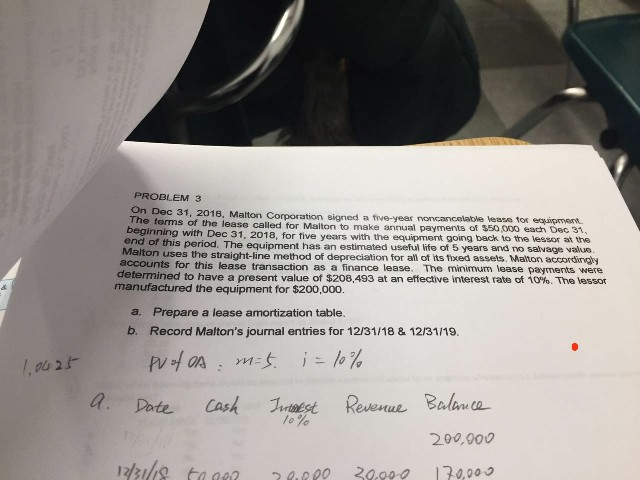

PROBLEM 3 On Dec 31, 2018, Malton Corporation signed a five-year noncancelable lease The torms of the lease called for Malton to make annual payments of $50000 each Dec 31. c 31, 2018, for five years with the equipment going back to the lessor at the beginning with De end of this period. The equipment has an estimated useful life of 5 years and no salvage value Malton uses the strai accounts for this lease transaction as a finance lease. The minimum lease payments were determined to have a present value of $208,493 at an effective interest rate of 10%. The essor manufactured the equipment for $200,000. a. Prepare a lease amortization table. b. Record Malton's journal entries for 12/31/18 & 12/31/19. r 4. nte Cash Adest Roenue balance- /0 % 200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts