Question: Problem 3: Options Combined (PRACTICE PROBLEM)* We want to create an advanced option strategy by buying one at-the-money call and one at-themoney put on a

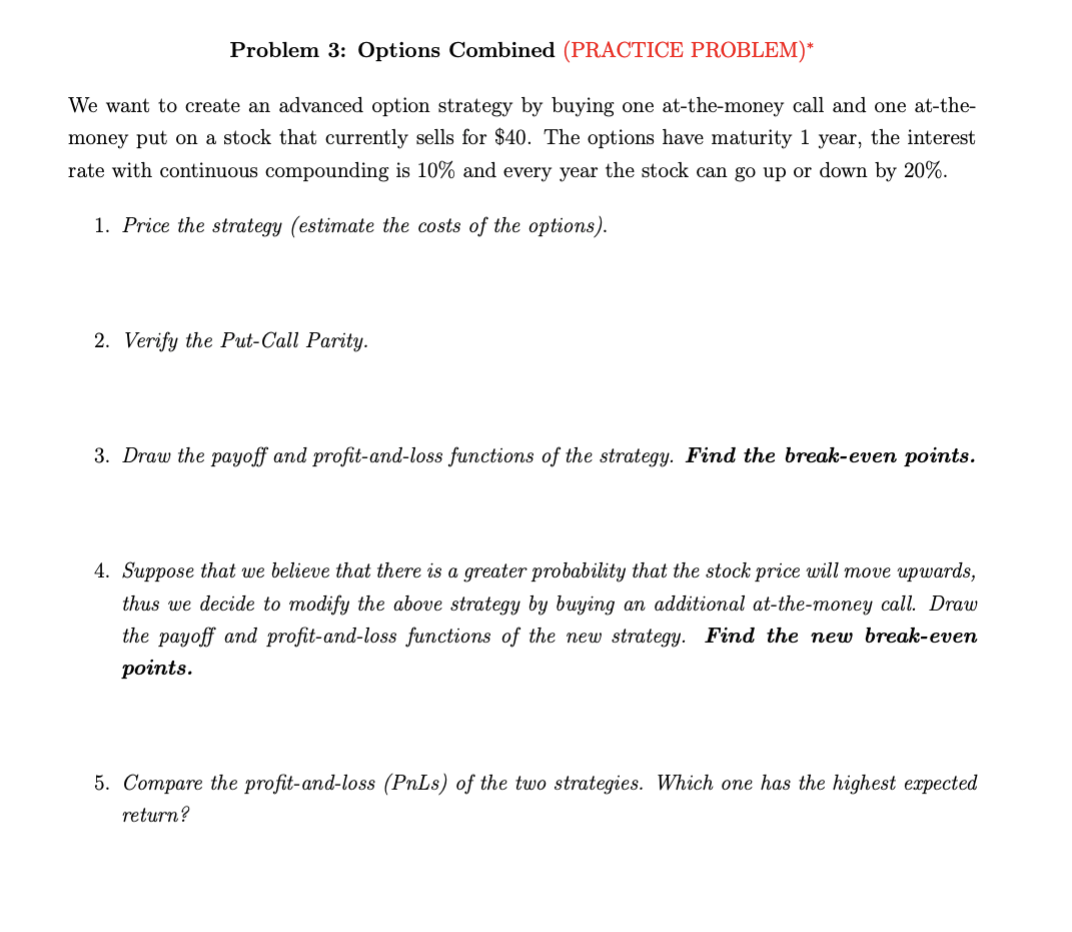

Problem 3: Options Combined (PRACTICE PROBLEM)* We want to create an advanced option strategy by buying one at-the-money call and one at-themoney put on a stock that currently sells for $40. The options have maturity 1 year, the interest rate with continuous compounding is 10% and every year the stock can go up or down by 20%. 1. Price the strategy (estimate the costs of the options). 2. Verify the Put-Call Parity. 3. Draw the payoff and profit-and-loss functions of the strategy. Find the break-even points. 4. Suppose that we believe that there is a greater probability that the stock price will move upwards, thus we decide to modify the above strategy by buying an additional at-the-money call. Draw the payoff and profit-and-loss functions of the new strategy. Find the new break-even points. 5. Compare the profit-and-loss (PnLs) of the two strategies. Which one has the highest expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts