Question: Problem #3: Price-Earnings Multiples (12 points) The market consensus is that Analog Electronic Corporation has an ROE of 9% and a beta of 1.25. It

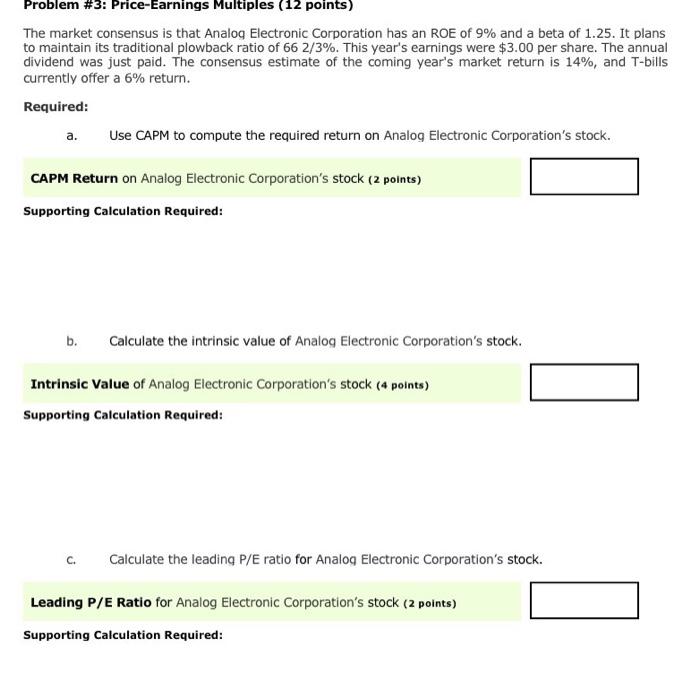

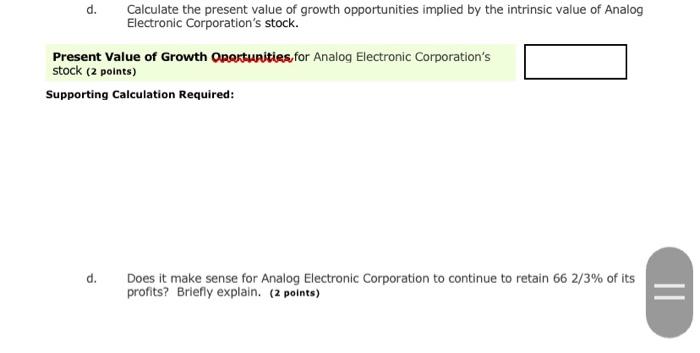

Problem #3: Price-Earnings Multiples (12 points) The market consensus is that Analog Electronic Corporation has an ROE of 9% and a beta of 1.25. It plans to maintain its traditional plowback ratio of 66 2/3%. This year's earnings were $3.00 per share. The annual dividend was just paid. The consensus estimate of the coming year's market return is 14%, and T-bills currently offer a 6% return. Required: a. Use CAPM to compute the required return on Analog Electronic Corporation's stock. CAPM Return on Analog Electronic Corporation's stock (2 points) Supporting Calculation Required: b. Calculate the intrinsic value of Analog Electronic Corporation's stock. Intrinsic Value of Analog Electronic Corporation's stock (4 points) Supporting Calculation Required: Calculate the leading P/E ratio for Analog Electronic Corporation's stock. Leading P/E Ratio for Analog Electronic Corporation's stock (2 points) Supporting Calculation Required: d. Calculate the present value of growth opportunities implied by the intrinsic value of Analog Electronic Corporation's stock. Present Value of Growth Oportunities for Analog Electronic Corporation's stock (2 points) Supporting Calculation Required: d. Does it make sense for Analog Electronic Corporation to continue to retain 66 2/3% of its profits? Briefly explain. (2 points) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts