Question: Problem 3 . Racquet Centers, Inc. ( RCI ) is a small investment company. The company is considering building a new racquet center. If the

Problem

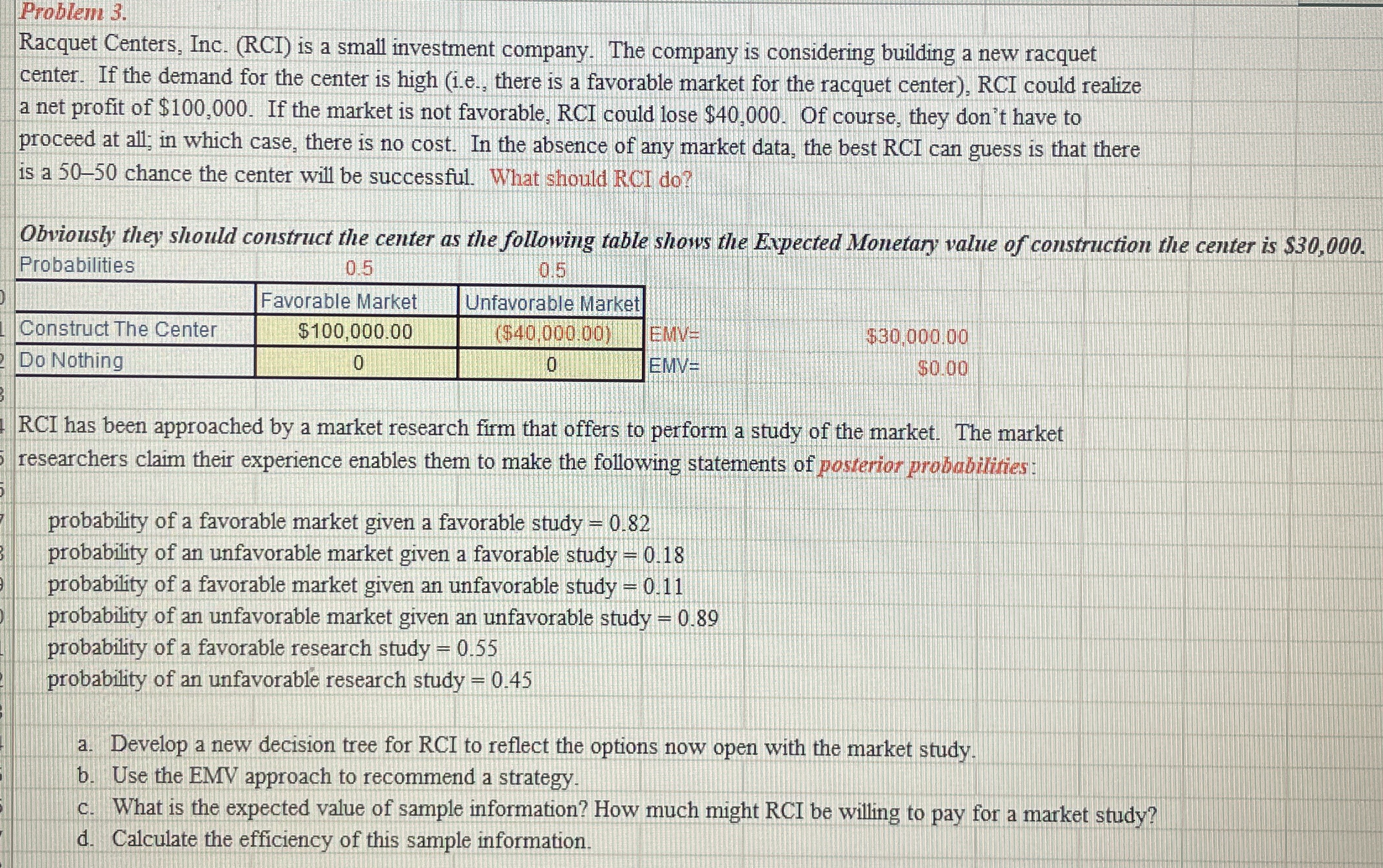

Racquet Centers, Inc. RCI is a small investment company. The company is considering building a new racquet center. If the demand for the center is high ie there is a favorable market for the racquet center RCI could realize a net profit of $ If the market is not favorable, RCI could lose $ Of course, they don't have to proceed at all; in which case, there is no cost In the absence of any market data, the best RCI can guess is that there is a chance the center will be successful. What should RCI do

Obviously they should construct the center as the following table shows the Expected Monetary value of construction the center is $ Probabilities

tableFavorable Market,Unfavorable Market,,Construct The Center,$$EMV $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock