Question: Problem 3 (Required, 25 marks) Recently, Mr. A has 2 outstanding loans: Loan A - He needs to repay $1720 at the end of every

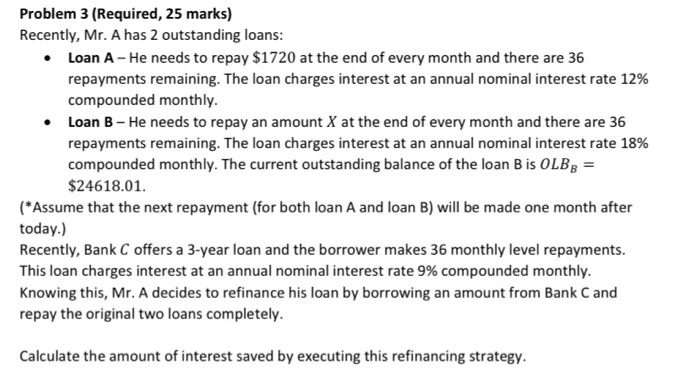

Problem 3 (Required, 25 marks) Recently, Mr. A has 2 outstanding loans: Loan A - He needs to repay $1720 at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 12% compounded monthly Loan B - He needs to repay an amount X at the end of every month and there are 36 repayments remaining. The loan charges interest at an annual nominal interest rate 18% compounded monthly. The current outstanding balance of the loan B is OLBB = $24618.01. (*Assume that the next repayment (for both loan A and loan B) will be made one month after today.) Recently, Bank C offers a 3-year loan and the borrower makes 36 monthly level repayments. This loan charges interest at an annual nominal interest rate 9% compounded monthly. Knowing this, Mr. A decides to refinance his loan by borrowing an amount from Bank C and repay the original two loans completely. Calculate the amount of interest saved by executing this refinancing strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts