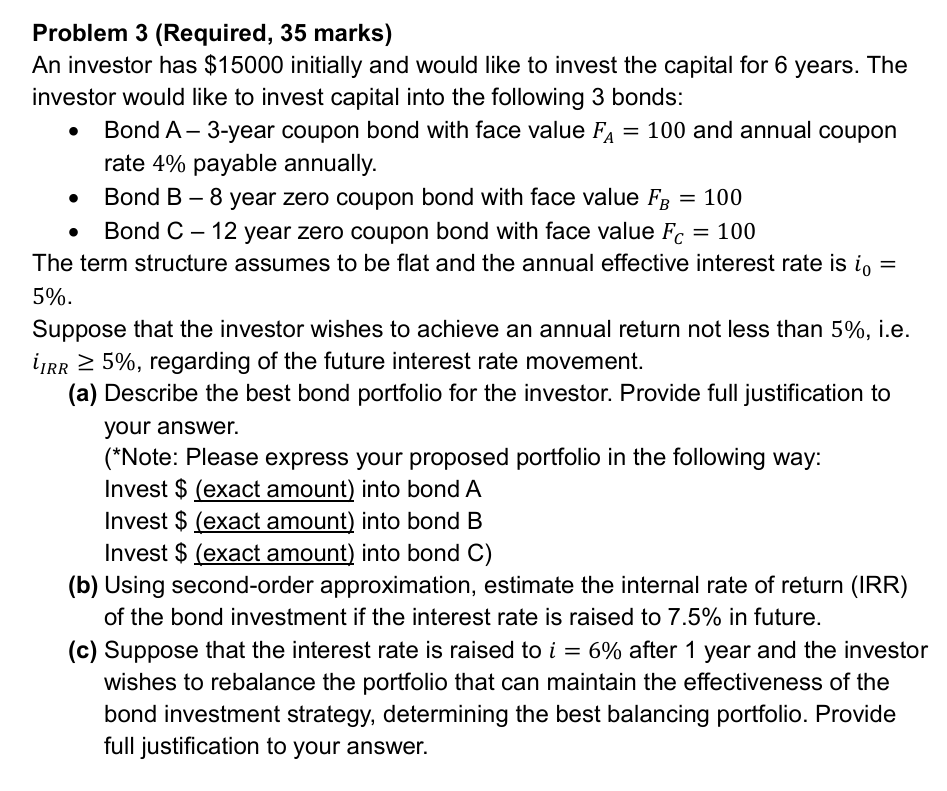

Question: Problem 3 ( Required , 3 5 marks ) An investor has ( $ 1 5 0 0 0 ) initially and

Problem Required marks An investor has $ initially and would like to invest the capital for years. The investor would like to invest capital into the following bonds: Bond Ayear coupon bond with face value FA and annual coupon rate payable annually. Bond mathrmB year zero coupon bond with face value FB Bond C year zero coupon bond with face value FC The term structure assumes to be flat and the annual effective interest rate is i Suppose that the investor wishes to achieve an annual return not less than ie iI R Rgeq regarding of the future interest rate movement. a Describe the best bond portfolio for the investor. Provide full justification to your answer. Note: Please express your proposed portfolio in the following way: Invest $ exact amount into bond A Invest $ exact amount into bond B Invest $ exact amount into bond C b Using secondorder approximation, estimate the internal rate of return IRR of the bond investment if the interest rate is raised to in future. c Suppose that the interest rate is raised to i after year and the investor wishes to rebalance the portfolio that can maintain the effectiveness of the bond investment strategy, determining the best balancing portfolio. Provide full justification to your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock