Question: Problem 3 (Required, 40 marks) There are 3 bonds (Bond A, Bond B and Bond C) in a market: Bond A: It is a 2

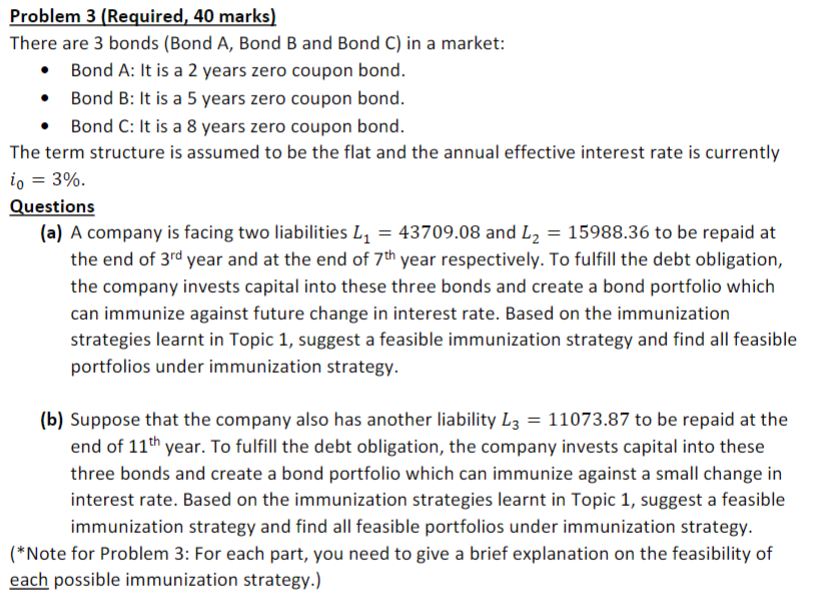

Problem 3 (Required, 40 marks) There are 3 bonds (Bond A, Bond B and Bond C) in a market: Bond A: It is a 2 years zero coupon bond. Bond B: It is a 5 years zero coupon bond. Bond C: It is a 8 years zero coupon bond. The term structure is assumed to be the flat and the annual effective interest rate is currently io = 3%. Questions (a) A company is facing two liabilities L2 = 43709.08 and L2 = 15988.36 to be repaid at the end of 3rd year and at the end of 7th year respectively. To fulfill the debt obligation, the company invests capital into these three bonds and create a bond portfolio which can immunize against future change in interest rate. Based on the immunization strategies learnt in Topic 1, suggest a feasible immunization strategy and find all feasible portfolios under immunization strategy. (b) Suppose that the company also has another liability L3 = 11073.87 to be repaid at the end of 11th year. To fulfill the debt obligation, the company invests capital into these three bonds and create a bond portfolio which can immunize against a small change in interest rate. Based on the immunization strategies learnt in Topic 1, suggest a feasible immunization strategy and find all feasible portfolios under immunization strategy. (*Note for Problem 3: For each part, you need to give a brief explanation on the feasibility of each possible immunization strategy.) Problem 3 (Required, 40 marks) There are 3 bonds (Bond A, Bond B and Bond C) in a market: Bond A: It is a 2 years zero coupon bond. Bond B: It is a 5 years zero coupon bond. Bond C: It is a 8 years zero coupon bond. The term structure is assumed to be the flat and the annual effective interest rate is currently io = 3%. Questions (a) A company is facing two liabilities L2 = 43709.08 and L2 = 15988.36 to be repaid at the end of 3rd year and at the end of 7th year respectively. To fulfill the debt obligation, the company invests capital into these three bonds and create a bond portfolio which can immunize against future change in interest rate. Based on the immunization strategies learnt in Topic 1, suggest a feasible immunization strategy and find all feasible portfolios under immunization strategy. (b) Suppose that the company also has another liability L3 = 11073.87 to be repaid at the end of 11th year. To fulfill the debt obligation, the company invests capital into these three bonds and create a bond portfolio which can immunize against a small change in interest rate. Based on the immunization strategies learnt in Topic 1, suggest a feasible immunization strategy and find all feasible portfolios under immunization strategy. (*Note for Problem 3: For each part, you need to give a brief explanation on the feasibility of each possible immunization strategy.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts