Question: Problem 3 Rubberman is considering a major change in its capital structure. It has three options: Option 1 : Issue S 1 billion in new

Problem

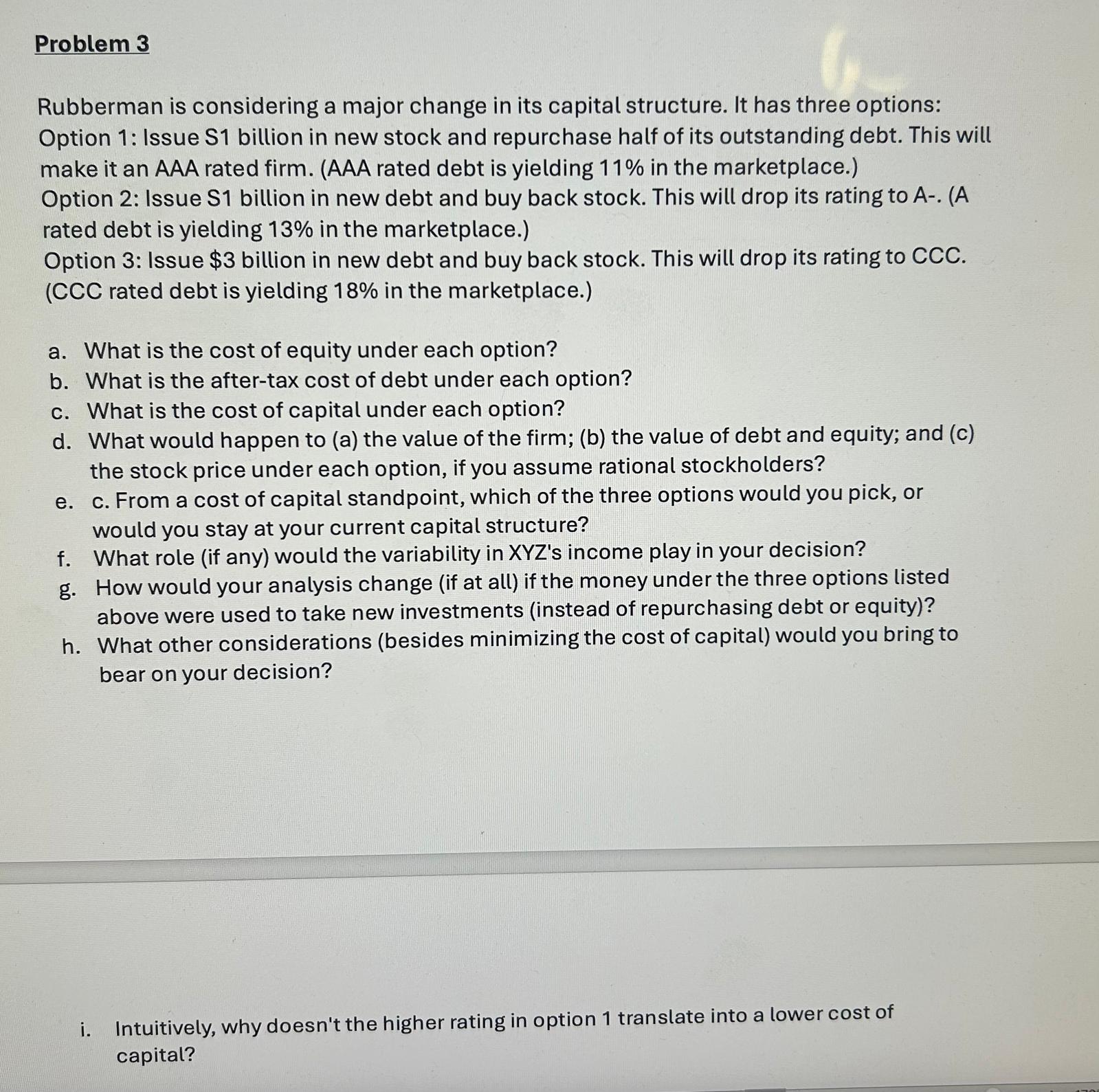

Rubberman is considering a major change in its capital structure. It has three options:

Option : Issue billion in new stock and repurchase half of its outstanding debt. This will

make it an AAA rated firm. AAA rated debt is yielding in the marketplace.

Option : Issue S billion in new debt and buy back stock. This will drop its rating to AA

rated debt is yielding in the marketplace.

Option : Issue $ billion in new debt and buy back stock. This will drop its rating to CCC

CCC rated debt is yielding in the marketplace.

a What is the cost of equity under each option?

b What is the aftertax cost of debt under each option?

c What is the cost of capital under each option?

d What would happen to a the value of the firm; b the value of debt and equity; and c

the stock price under each option, if you assume rational stockholders?

e From a cost of capital standpoint, which of the three options would you pick, or

would you stay at your current capital structure?

f What role if any would the variability in XYZs income play in your decision?

g How would your analysis change if at all if the money under the three options listed

above were used to take new investments instead of repurchasing debt or equity

h What other considerations besides minimizing the cost of capital would you bring to

bear on your decision?

i Intuitively, why doesn't the higher rating in option translate into a lower cost of

capital?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock