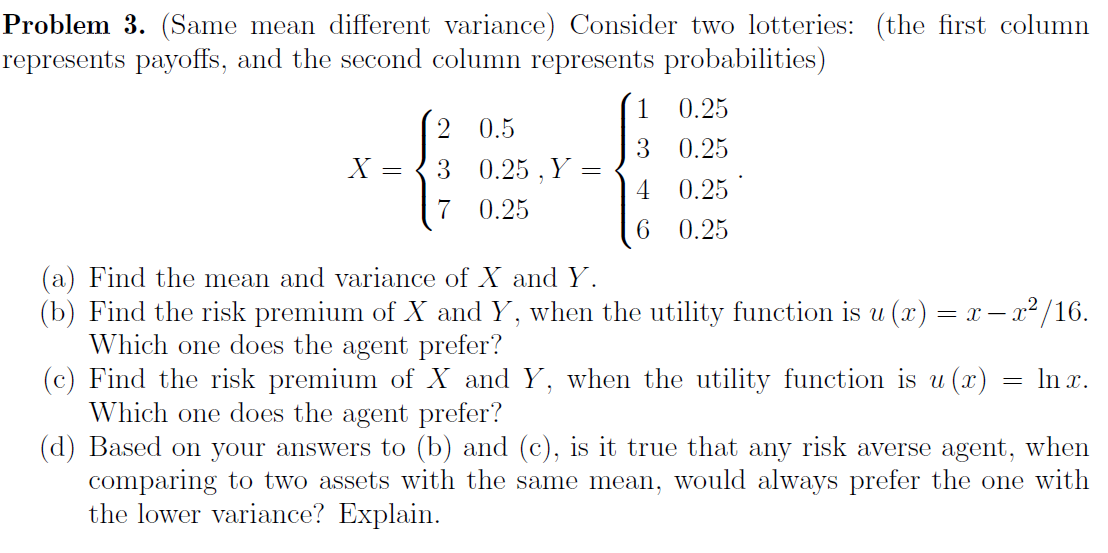

Question: Problem 3. (Same mean different variance) Consider two lotteries: (the first column represents payoffs, and the second column represents probabilities) 1 0.25 3 0.25 X

Problem 3. (Same mean different variance) Consider two lotteries: (the first column represents payoffs, and the second column represents probabilities) 1 0.25 3 0.25 X 2 0.5 3 0.25 , Y 7 0.25 = 4 0.25 6 0.25 (a) Find the mean and variance of X and Y. (b) Find the risk premium of X and Y , when the utility function is u (x) = x x2/16. Which one does the agent prefer? (c) Find the risk premium of X and Y, when the utility function is u (x) = In x. Which one does the agent prefer? (d) Based on your answers to (b) and (c), is it true that any risk averse agent, when comparing to two assets with the same mean, would always prefer the one with the lower variance? Explain. Problem 3. (Same mean different variance) Consider two lotteries: (the first column represents payoffs, and the second column represents probabilities) 1 0.25 3 0.25 X 2 0.5 3 0.25 , Y 7 0.25 = 4 0.25 6 0.25 (a) Find the mean and variance of X and Y. (b) Find the risk premium of X and Y , when the utility function is u (x) = x x2/16. Which one does the agent prefer? (c) Find the risk premium of X and Y, when the utility function is u (x) = In x. Which one does the agent prefer? (d) Based on your answers to (b) and (c), is it true that any risk averse agent, when comparing to two assets with the same mean, would always prefer the one with the lower variance? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts