Question: Problem 3. Savings and the Solow Model (8 points). Consider an economy described by the Solow growth model. The production function is: F(K, L) =

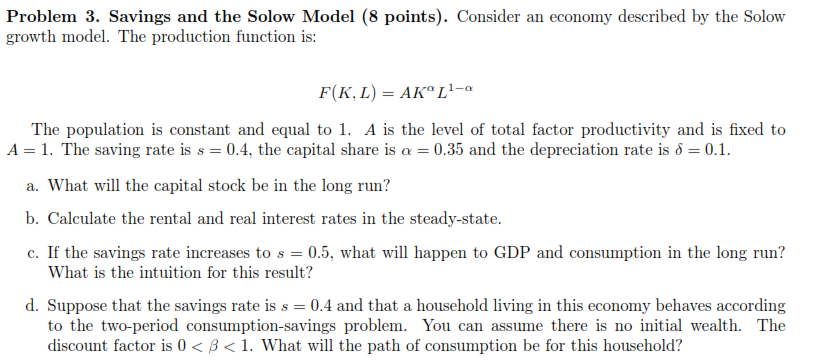

Problem 3. Savings and the Solow Model (8 points). Consider an economy described by the Solow growth model. The production function is: F(K, L) = AKL-a The population is constant and equal to 1. A is the level of total factor productivity and is fixed to A= 1. The saving rate is s = 0.4, the capital share is a = 0.35 and the depreciation rate is 8 = 0.1. a. What will the capital stock be in the long run? b. Calculate the rental and real interest rates in the steady-state. c. If the savings rate increases to s = 0.5, what will happen to GDP and consumption in the long run? What is the intuition for this result? d. Suppose that the savings rate is s = 0.4 and that a household living in this economy behaves according to the two-period consumption-savings problem. You can assume there is no initial wealth. The discount factor is 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts