Question: PROBLEM 3 The Generous Returns Company is evaluating the impact to stockholders equity for three scenarios: a stock split and two different stock dividends. First,

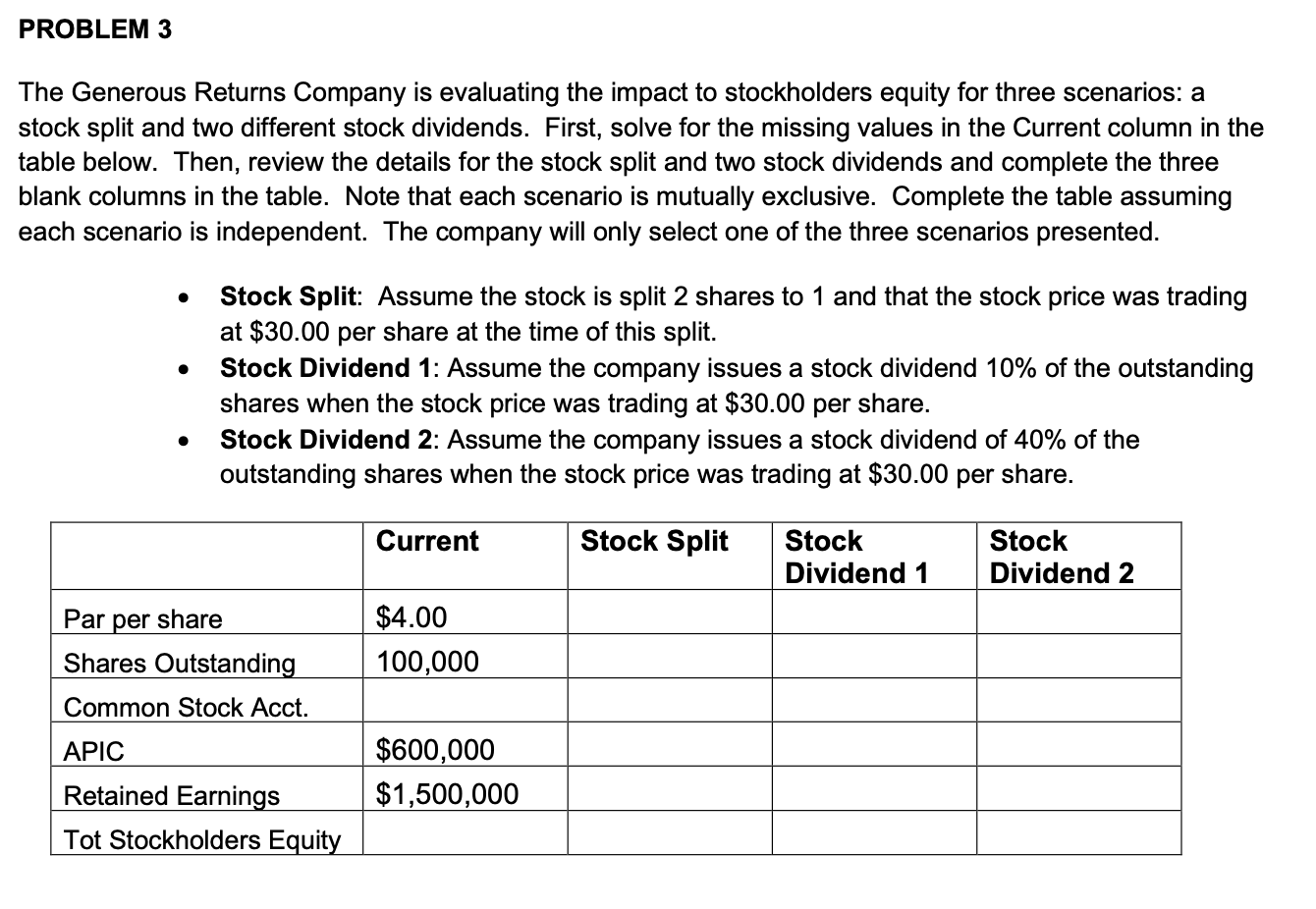

PROBLEM 3 The Generous Returns Company is evaluating the impact to stockholders equity for three scenarios: a stock split and two different stock dividends. First, solve for the missing values in the Current column in the table below. Then, review the details for the stock split and two stock dividends and complete the three blank columns in the table. Note that each scenario is mutually exclusive. Complete the table assuming each scenario is independent. The company will only select one of the three scenarios presented. . Stock Split: Assume the stock is split 2 shares to 1 and that the stock price was trading at $30.00 per share at the time of this split. . Stock Dividend 1: Assume the company issues a stock dividend 10% of the outstanding shares when the stock price was trading at $30.00 per share. . Stock Dividend 2: Assume the company issues a stock dividend of 40% of the outstanding shares when the stock price was trading at $30.00 per share. Current Stock Split Stock Stock Dividend 1 Dividend 2 Par per share $4.00 Shares Outstanding 100,000 Common Stock Acct. APIC $600,000 Retained Earnings $1,500,000 Tot Stockholders Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts