Question: Problem 3: This problem will get you familiar to the idea that investors with different risk aversion coefficients will make different choices when facing the

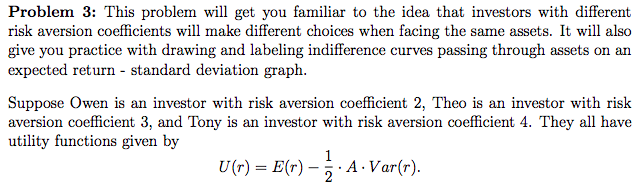

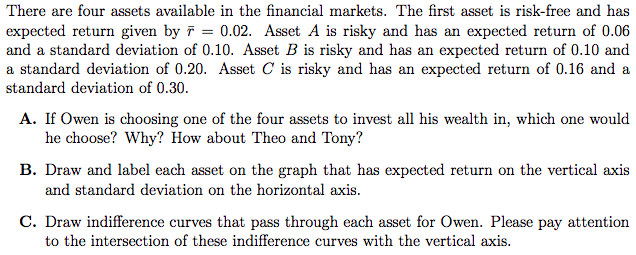

Problem 3: This problem will get you familiar to the idea that investors with different risk aversion coefficients will make different choices when facing the same assets. It will also give you practice with drawing and labeling indifference curves passing through assets on an expected return - standard deviation graph Suppose Owen is an investor with risk aversion coefficient 2, Theo is an investor with risk aversion coefficient 3, and Tony is an investor with risk aversion coefficient 4. They all have utility functions given by U(r) = E(r)-2 . A. Var(r)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts