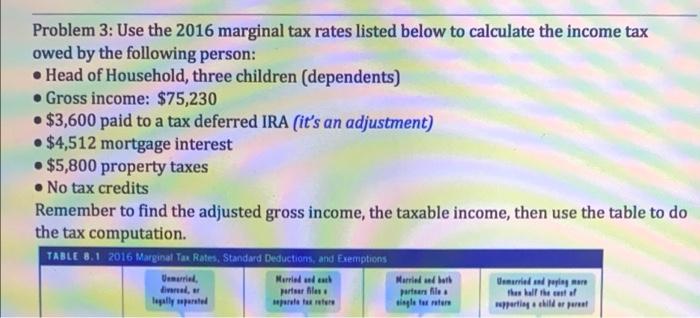

Question: Problem 3: Use the 2016 marginal tax rates listed below to calculate the income tax owed by the following person: Head of Household, three

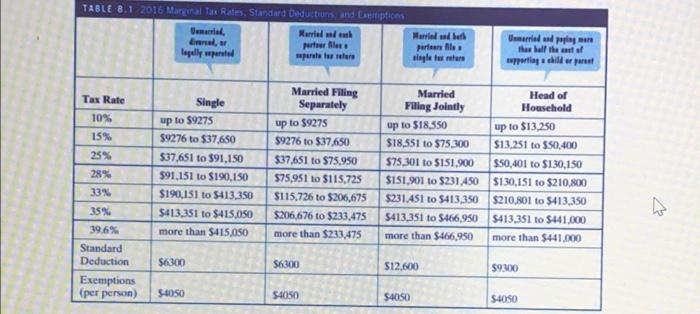

Problem 3: Use the 2016 marginal tax rates listed below to calculate the income tax owed by the following person: Head of Household, three children (dependents) Gross income: $75,230 $3,600 paid to a tax deferred IRA (it's an adjustment) $4,512 mortgage interest $5,800 property taxes No tax credits Remember to find the adjusted gross income, the taxable income, then use the table to do the tax computation. TABLE 8.1 2016 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried, dinni, legally separated Married and each perteer files separate tax refere Married and bath partners file a single tax ratere Unmarried and paying mar the half the cost of supporting a child or parent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts