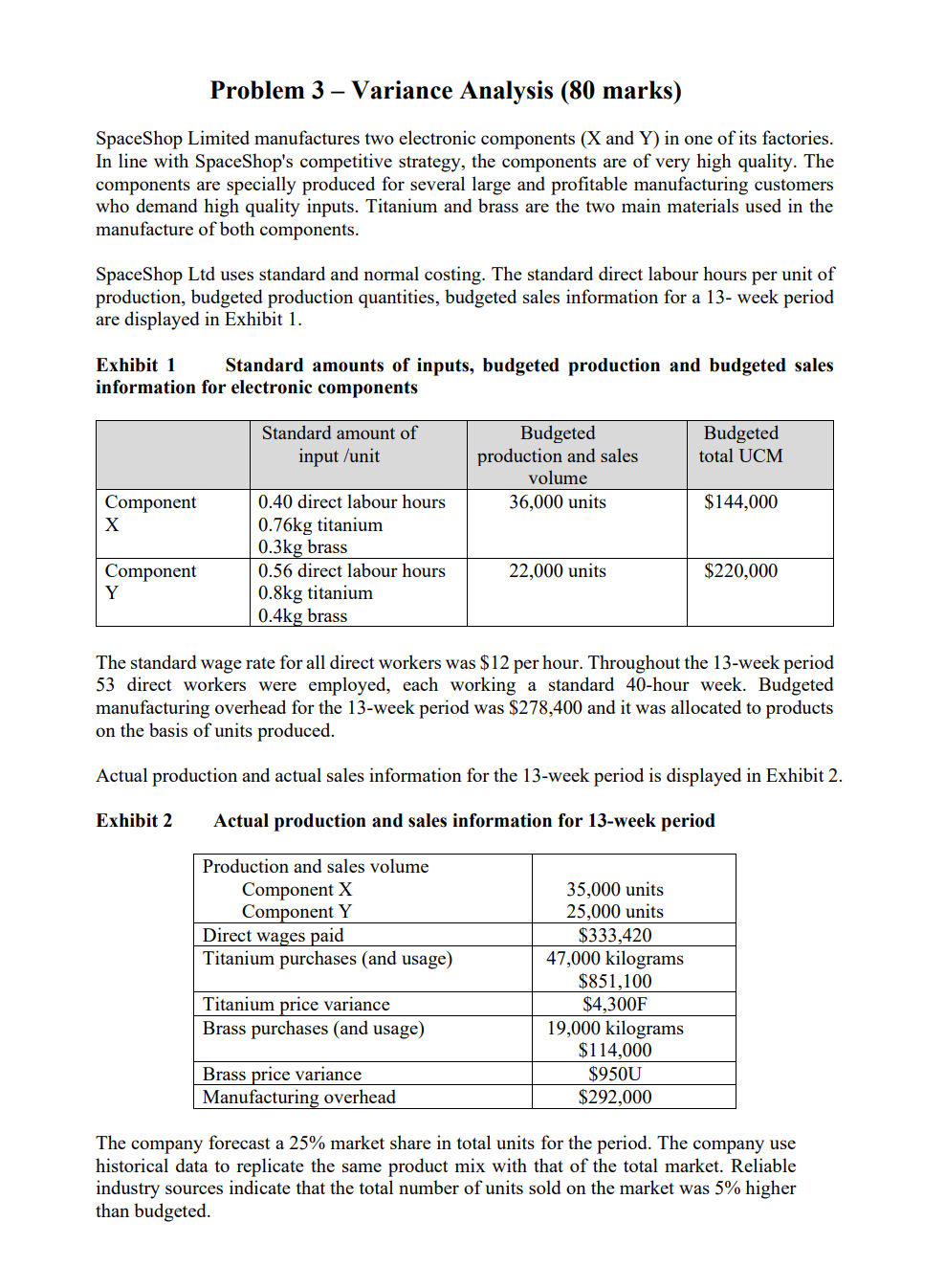

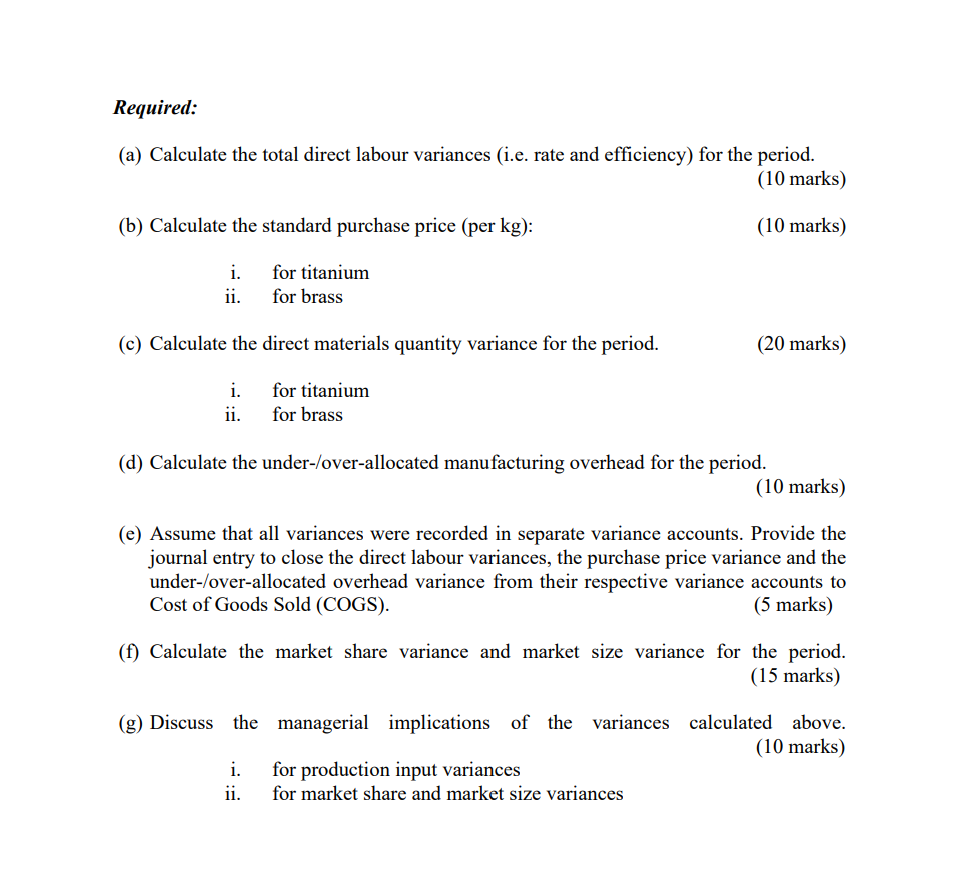

Question: Problem 3 Variance Analysis (80 marks) SpaceShop Limited manufactures two electronic components (X and Y) in one of its factories. In line with SpaceShop's competitive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts