Question: Problem 3 (Watson 10.2 a-c). Consider a more general Bertrand model than the one presented in this chapter. Suppose there are n firms that simultaneously

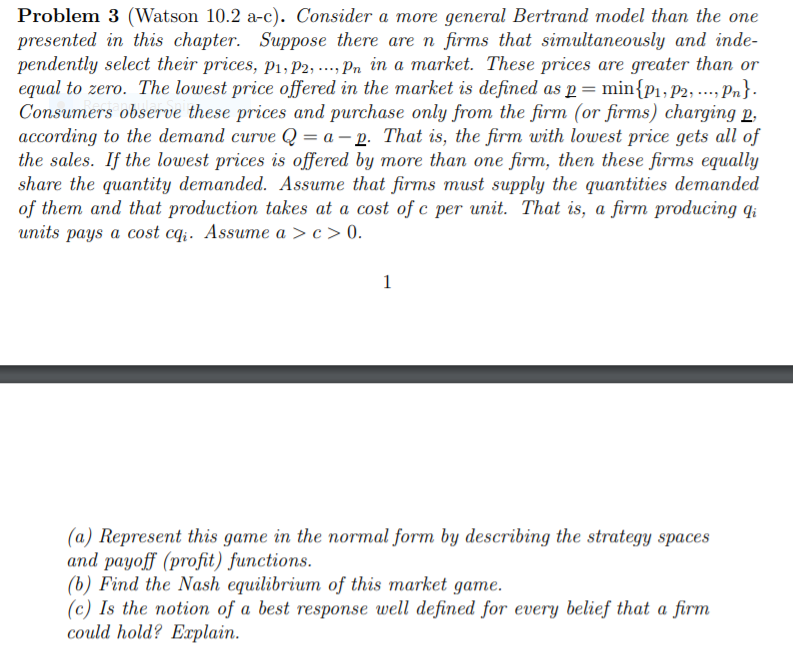

Problem 3 (Watson 10.2 a-c). Consider a more general Bertrand model than the one presented in this chapter. Suppose there are n firms that simultaneously and inde- pendently select their prices, P1, P2, ..., Pn in a market. These prices are greater than or equal to zero. The lowest price offered in the market is defined as p = min{P1, P2, ..., Pn}. Consumers observe these prices and purchase only from the firm (or firms) charging pa according to the demand curve Q = a - p. That is, the firm with lowest price gets all of the sales. If the lowest prices is offered by more than one firm, then these firms equally share the quantity demanded. Assume that firms must supply the quantities demanded of them and that production takes at a cost of c per unit. That is, a firm producing qi units pays a cost cqi. Assume a >c>0. 1 (a) Represent this game in the normal form by describing the strategy spaces and payoff (profit) functions. (6) Find the Nash equilibrium of this market game. (c) Is the notion of a best response well defined for every belief that a firm could hold? Explain. Problem 3 (Watson 10.2 a-c). Consider a more general Bertrand model than the one presented in this chapter. Suppose there are n firms that simultaneously and inde- pendently select their prices, P1, P2, ..., Pn in a market. These prices are greater than or equal to zero. The lowest price offered in the market is defined as p = min{P1, P2, ..., Pn}. Consumers observe these prices and purchase only from the firm (or firms) charging pa according to the demand curve Q = a - p. That is, the firm with lowest price gets all of the sales. If the lowest prices is offered by more than one firm, then these firms equally share the quantity demanded. Assume that firms must supply the quantities demanded of them and that production takes at a cost of c per unit. That is, a firm producing qi units pays a cost cqi. Assume a >c>0. 1 (a) Represent this game in the normal form by describing the strategy spaces and payoff (profit) functions. (6) Find the Nash equilibrium of this market game. (c) Is the notion of a best response well defined for every belief that a firm could hold? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts