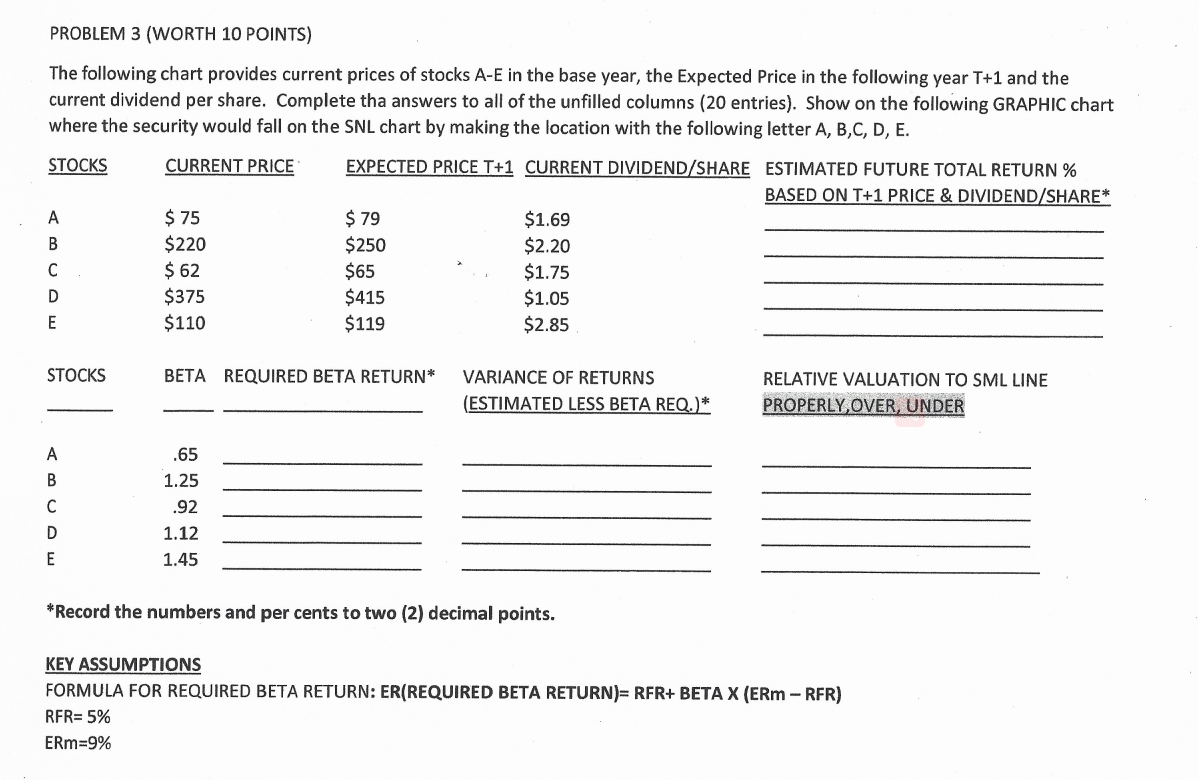

Question: PROBLEM 3 (WORTH 10 POINTS) The following chart provides current prices of stocks A-E in the base year, the Expected Price in the following year

PROBLEM 3 (WORTH 10 POINTS) The following chart provides current prices of stocks A-E in the base year, the Expected Price in the following year T+1 and the current dividend per share. Complete tha answers to all of the unfilled columns (20 entries). Show on the following GRAPHIC chart where the security would fall on the SNL chart by making the location with the following letter A, B,C, D, E. STOCKS CURRENT PRICE A B EXPECTED PRICE T+1 CURRENT DIVIDEND/SHARE ESTIMATED FUTURE TOTAL RETURN % BASED ON T+1 PRICE & DIVIDEND/SHARE* $ 79 $1.69 $250 $2.20 $65 $1.75 $415 $1.05 $ 119 $2.85 $ 75 $220 $ 62 $375 $110 C D E STOCKS BETA REQUIRED BETA RETURN* VARIANCE OF RETURNS (ESTIMATED LESS BETA REQ.)* RELATIVE VALUATION TO SML LINE PROPERLY, OVER, UNDER A B D .65 1.25 .92 1.12 1.45 E *Record the numbers and per cents to two (2) decimal points. KEY ASSUMPTIONS FORMULA FOR REQUIRED BETA RETURN: ER(REQUIRED BETA RETURN)= RFR+ BETA X (ERM -RFR) RFR= 5% ERm=9% PROBLEM 3 (WORTH 10 POINTS) The following chart provides current prices of stocks A-E in the base year, the Expected Price in the following year T+1 and the current dividend per share. Complete tha answers to all of the unfilled columns (20 entries). Show on the following GRAPHIC chart where the security would fall on the SNL chart by making the location with the following letter A, B,C, D, E. STOCKS CURRENT PRICE A B EXPECTED PRICE T+1 CURRENT DIVIDEND/SHARE ESTIMATED FUTURE TOTAL RETURN % BASED ON T+1 PRICE & DIVIDEND/SHARE* $ 79 $1.69 $250 $2.20 $65 $1.75 $415 $1.05 $ 119 $2.85 $ 75 $220 $ 62 $375 $110 C D E STOCKS BETA REQUIRED BETA RETURN* VARIANCE OF RETURNS (ESTIMATED LESS BETA REQ.)* RELATIVE VALUATION TO SML LINE PROPERLY, OVER, UNDER A B D .65 1.25 .92 1.12 1.45 E *Record the numbers and per cents to two (2) decimal points. KEY ASSUMPTIONS FORMULA FOR REQUIRED BETA RETURN: ER(REQUIRED BETA RETURN)= RFR+ BETA X (ERM -RFR) RFR= 5% ERm=9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts