Question: Problem 3 You started a fancy popsicle store in Chicago called Pop Stop. It's a huge success (congratulations!). You would like to expand to New

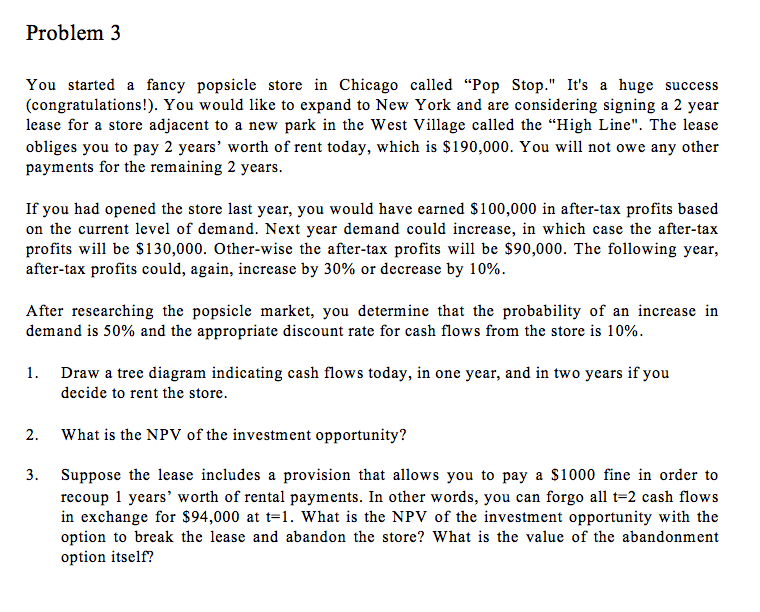

Problem 3 You started a fancy popsicle store in Chicago called "Pop Stop." It's a huge success (congratulations!). You would like to expand to New York and are considering signing a 2 year lease for a store adjacent to a new park in the West Village called the "High Line". The lease obliges you to pay 2 years' worth of rent today, which is $190,000. You will not owe any other payments for the remaining 2 years If you had opened the store last year, you would have earned S100,000 in after-tax profits based on the current level of demand. Next year demand could increase, in which case the after-tax profits will be S130,000. Other-wise the after-tax profits will be S90,000. The following year, after-tax profits could, again, increase by 30% or decrease by 10%. After researching the popsicle market, you determine that the probability of an increase in demand is 50% and the appropriate discount rate for cash flows from the store is 10%. Draw a tree diagram indicating cash flows today, in one year, and in two years if you decide to rent the store 1. 2. What is the NPV of the investment opportunity? Suppose the lease includes a provision that allows you to pay a S1000 fine in order to recoup 1 years' worth of rental payments. In other words, you can forgo all t-2 cash flows in exchange for $94,000 at t-1. What is the NPV of the investment opportunity with the option to break the lease and abandon the store? What is the value of the abandonment option itself? 3. Problem 3 You started a fancy popsicle store in Chicago called "Pop Stop." It's a huge success (congratulations!). You would like to expand to New York and are considering signing a 2 year lease for a store adjacent to a new park in the West Village called the "High Line". The lease obliges you to pay 2 years' worth of rent today, which is $190,000. You will not owe any other payments for the remaining 2 years If you had opened the store last year, you would have earned S100,000 in after-tax profits based on the current level of demand. Next year demand could increase, in which case the after-tax profits will be S130,000. Other-wise the after-tax profits will be S90,000. The following year, after-tax profits could, again, increase by 30% or decrease by 10%. After researching the popsicle market, you determine that the probability of an increase in demand is 50% and the appropriate discount rate for cash flows from the store is 10%. Draw a tree diagram indicating cash flows today, in one year, and in two years if you decide to rent the store 1. 2. What is the NPV of the investment opportunity? Suppose the lease includes a provision that allows you to pay a S1000 fine in order to recoup 1 years' worth of rental payments. In other words, you can forgo all t-2 cash flows in exchange for $94,000 at t-1. What is the NPV of the investment opportunity with the option to break the lease and abandon the store? What is the value of the abandonment option itself? 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts