Question: problem 30 For example, assume Jackson wants to earn a return of 7.00% and is offered the opportunity to purchase a $1,000 par value bond

problem 30

For example, assume Jackson wants to earn a return of 7.00% and is offered the opportunity to purchase a $1,000 par value bond that pays a 7.00% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the bond's intrinsic value:

omplete the following table by identifying the appropriate corresponding variables used in the equation.

Unknown

Variable Name

Variable Value

A Bond's semiannual coupon payment

B $1,000

C Semiannual required return

Based on this equation and the data, it isto expect that Jackson's potential bond investment is currently exhibiting an intrinsic value equal to $1,000.

Now, consider the situation in which Jackson wants to earn a return of 10%, but the bond being considered for purchase offers a coupon rate of 7.00%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of(rounded to the nearest whole dollar) isits par value, so that the bond is.

Given your computation and conclusions, which of the following statements is true?

When the coupon rate is greater than Jackson's required return, the bond should trade at a premium.

When the coupon rate is greater than Jackson's required return, the bond should trade at a discount.

A bond should trade at a par when the coupon rate is greater than Jackson's required return.

When the coupon rate is greater than Jackson's required return, the bond's intrinsic value will be less than its par value.

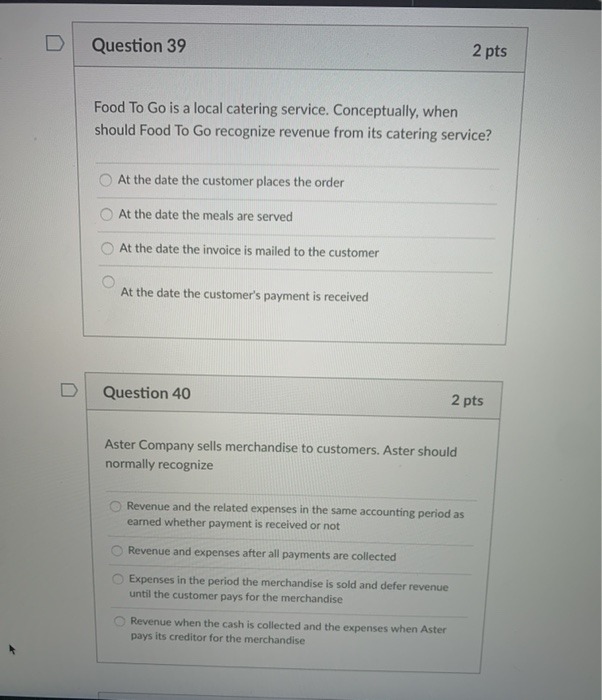

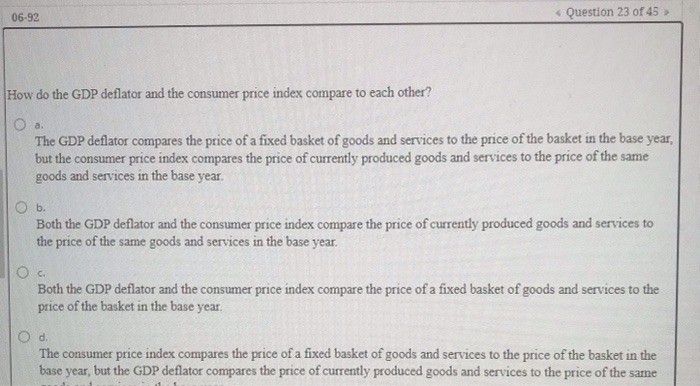

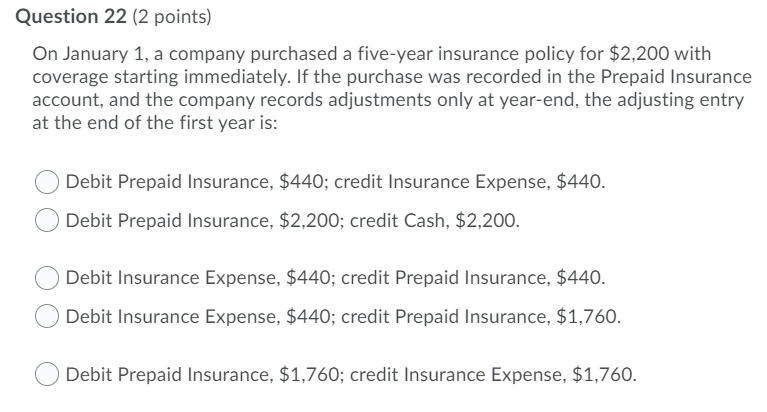

D Question 39 2 pts Food To Go is a local catering service. Conceptually, when should Food To Go recognize revenue from its catering service? O At the date the customer places the order At the date the meals are served At the date the invoice is mailed to the customer O At the date the customer's payment is received D Question 40 2 pts Aster Company sells merchandise to customers. Aster should normally recognize Revenue and the related expenses in the same accounting period as earned whether payment is received or not Revenue and expenses after all payments are collected Expenses in the period the merchandise is sold and defer revenue until the customer pays for the merchandise O Revenue when the cash is collected and the expenses when Aster pays its creditor for the merchandise06-92 Question 23 of 45 How do the GDP deflator and the consumer price index compare to each other? O a. The GDP deflator compares the price of a fixed basket of goods and services to the price of the basket in the base year, but the consumer price index compares the price of currently produced goods and services to the price of the same goods and services in the base year. O b. Both the GDP deflator and the consumer price index compare the price of currently produced goods and services to the price of the same goods and services in the base year. O c Both the GDP deflator and the consumer price index compare the price of a fixed basket of goods and services to the price of the basket in the base year. O d The consumer price index compares the price of a fixed basket of goods and services to the price of the basket in the base year, but the GDP deflator compares the price of currently produced goods and services to the price of the sameQuestion 22 {2 points} On January 1. a company purchased a fiye-year insurance policy for $2,200 with coverage starting immediately. If the purchase was recorded in the Prepaid Insurance account. and the company records adjustments only at year-end, the adjusting entry at the end of the first year is: 0 Debit Prepaid Insurance. $440; credit Insurance Expense. $440. 0 Debit Prepaid Insurance. $2.200; credit Cash. $2.200. 0 Debit Insurance Expense. $440; credit Prepaid Insurance, $440. 0 Debit Insurance Expense. $440; credit Prepaid Insurance. $1360. 0 Debit Prepaid Insurance. $1.?60; credit Insurance Expense. $1360