Question: Problem 3-12 Equity Multiplier and Return on Equity [LO3] Kodi Company has a debt-equity ratio of .60. Return on assets is 7.7 percent, and total

![Problem 3-12 Equity Multiplier and Return on Equity [LO3] Kodi Company](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66ded71401af2_08366ded71393957.jpg)

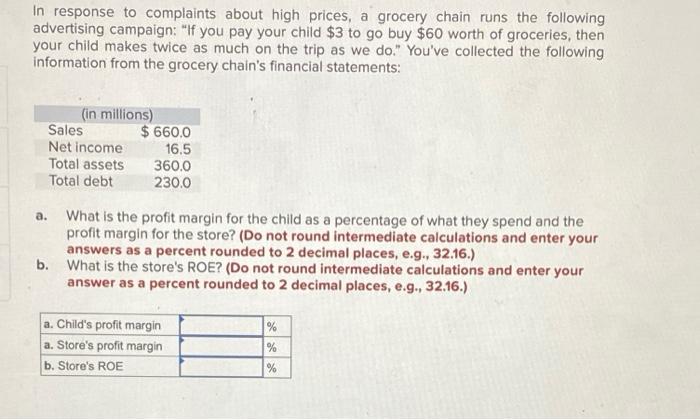

Problem 3-12 Equity Multiplier and Return on Equity [LO3] Kodi Company has a debt-equity ratio of .60. Return on assets is 7.7 percent, and total equity is $520,000. a. What is the equity multiplier? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the return on equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) What is the net income? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) C. a. Equity multiplier b. Return on equity c. Net income times % In response to complaints about high prices, a grocery chain runs the following advertising campaign: "If you pay your child $3 to go buy $60 worth of groceries, then your child makes twice as much on the trip as we do." You've collected the following information from the grocery chain's financial statements: (in millions) a. Sales Net income Total assets Total debt $660.0 16.5 360.0 230.0 What is the profit margin for the child as a percentage of what they spend and the profit margin for the store? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the store's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Child's profit margin a. Store's profit margin b. Store's ROE % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts