Question: Problem 3-12 (LO. 2) Mini, Inc., earns pretax book net income of $750,000 in 2018. Mini deducted $20,000 in bad debt expense for book purposes.

Problem 3-12 (LO. 2)

Mini, Inc., earns pretax book net income of $750,000 in 2018. Mini deducted $20,000 in bad debt expense for book purposes. This expense is not yet deductible for tax purposes. Mini records no other temporary or permanent differences. Assuming that the pertinent U.S. Federal corporate income tax rate is 21%, and Mini earns an after-tax rate of return on capital of 8%.

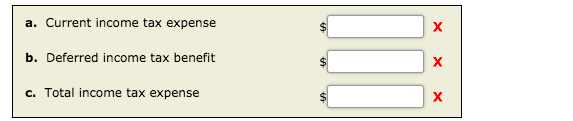

Compute Mini's total income tax expense, current income tax expense, and deferred income tax expense.

a. Current income tax expense b. Deferred income tax benefit c. Total income tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts