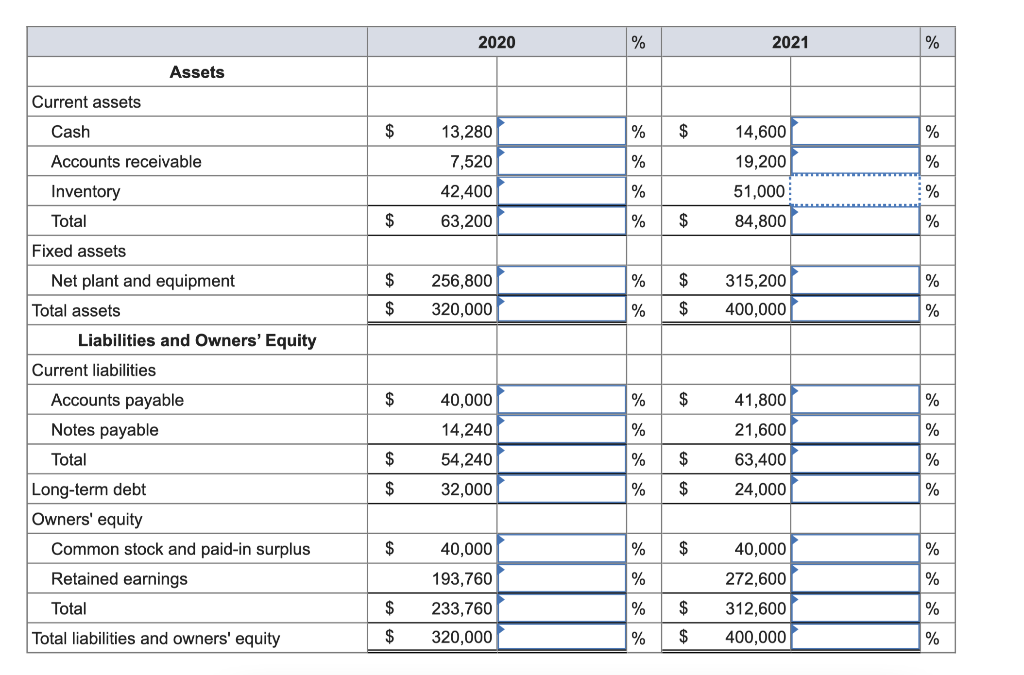

Question: Problem 3-13 Preparing Standardized Financial Statements [LO1] Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. 2020 2020 2021 Assets

![Problem 3-13 Preparing Standardized Financial Statements [LO1] Just Dew It Corporation](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f920a103d30_84866f920a07e0bd.jpg)

Problem 3-13 Preparing Standardized Financial Statements [LO1] Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. 2020 2020 2021 Assets Current assets Cash Accounts receivable Inventory JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $ 14,600 Accounts payable 19,200 Notes payable 51,000 $ 13,280 7,520 42,400 $ 40,000 $ 41,800 14,240 21,600 Total $ 63,200 $ 84,800 Total $ 54,240 $ 63,400 Long-term debt $32,000 $ 24,000 Owners' equity Common stock and paid-in surplus $ 40,000 $ 40,000 Retained earnings 193,760 272,600 Net plant and equipment $ $ 315,200 256,800 Total $ 233,760 $ 312,600 Total assets $ 320,000 $ 400,000 Total liabilities and owners' equity $ $ 320,000 400,000 Prepare the 2020 and 2021 common-size balance sheets for Just Dew It. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) 2020 % 2021 % Assets Current assets Cash $ % $ % Accounts receivable % % 13,280 7,520 42,400 63,200 14,600 19,200 51,000 84,800 % % Inventory Total $ % $ % Fixed assets Net plant and equipment $ % $ % 256,800 320,000 315,200 400,000 Total assets $ % $ % $ % $ % 40,000 14,240 % % 41,800 21,600 63,400 24,000 $ 54,240 % $ Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total % $ 32,000 % $ % $ % $ % 40,000 193,760 % % 40,000 272,600 312,600 400,000 $ % $ % 233,760 320,000 Total liabilities and owners' equity $ % $ %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts