Question: Problem 3-14 (Algorithmic) (LO. 2) In 2019, Mini reports $1,522,500 of pretax book net income. Mini did not deduct any bad debt expense for book

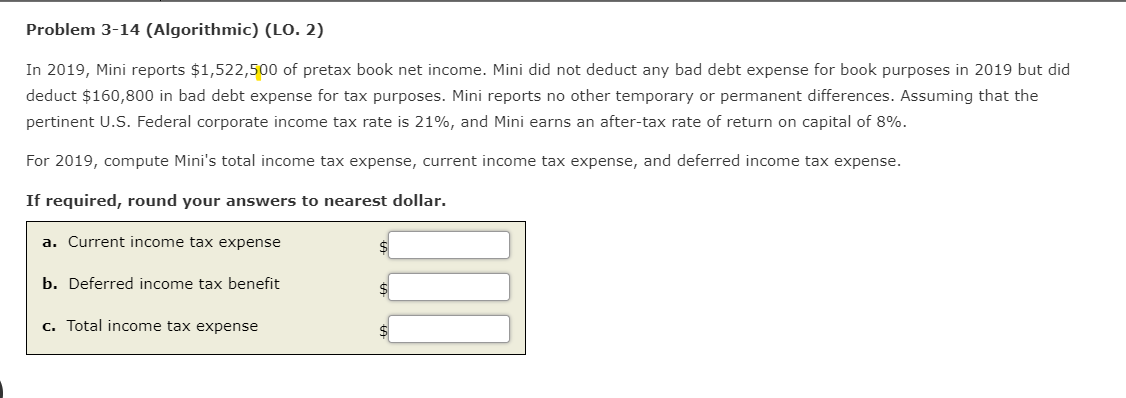

Problem 3-14 (Algorithmic) (LO. 2) In 2019, Mini reports $1,522,500 of pretax book net income. Mini did not deduct any bad debt expense for book purposes in 2019 but did deduct $160,800 in bad debt expense for tax purposes. Mini reports no other temporary or permanent differences. Assuming that the pertinent U.S. Federal corporate income tax rate is 21%, and Mini earns an after-tax rate of return on capital of 8%. For 2019, compute Mini's total income tax expense, current income tax expense, and deferred income tax expense. If required, round your answers to nearest dollar. a. Current income tax expense A b. Deferred income tax benefit A c. Total income tax expense A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts