Question: Problem 3-16 (Algorithmic) (Lo, 1, 4) Prance, Inc, eamed pretax book net income of $1,677,000 in 2020 . Prance acquired a depreciabie asset in 2020

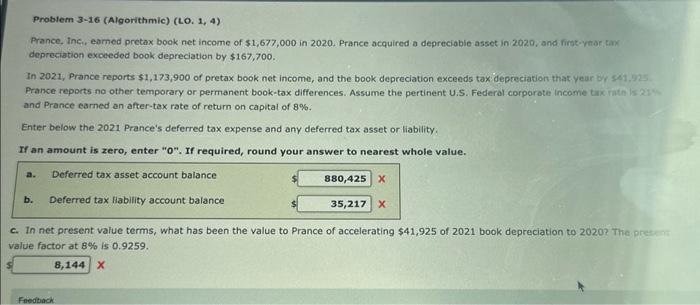

Problem 3-16 (Algorithmic) (Lo, 1, 4) Prance, Inc, eamed pretax book net income of $1,677,000 in 2020 . Prance acquired a depreciabie asset in 2020 , and first-yrar taxx depreciation exceeded book depreciation by $167,700. In 2021, Prance reports $1,173,900 of pretax book net income, and the book depreciation exceeds tax depreciation that yeur by $41.12, Prance reports no other temporary or permanent book-tax differences. Assume the pertinent U.S. Federal corporate income tix rith 13.21 and Prance earned an after-tax rate of return on capital of 8%. Enter below the 2021 Prance's deferred tax expense and any deferred tax asset or liability. If an amount is zero, enter " 0 ". If required, round your answer to nearest whole value. c. In net present value terms, what has been the value to Prance of accelerating $41,925 of 2021 book depreciation to 2020? The pret value factor at B% is 0.9259

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts