Question: Problem 3-2 On January 1, 2016, Ron started a baseball book business that he named Ron's Baseball Books (RBB). The company experienced the following events

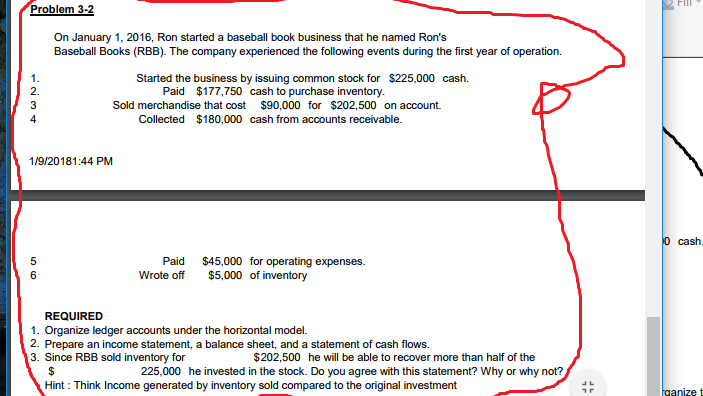

Problem 3-2 On January 1, 2016, Ron started a baseball book business that he named Ron's Baseball Books (RBB). The company experienced the following events during the first year of operation. Started the business by issuing common stock for $225,000 cash. 2. Paid $177,750 cash to purchase inventory. Sold merchandise that cost $90,000 for $202,500 on account. Collected $180,000 cash from accounts receivable 1/9/20181:44 PM cash Paid $45,000 for operating expenses. Wrote off $5,000 of inventory REQUIRED 1. Organize ledger accounts under the horizontal model. 2. Prepare an income statement, a balance sheet, and a statement of cash flows. 3. Since RBB sold inventory for $202,500 he will be able to recover more than half of the 225,000 he invested in the stock. Do you agree with this statement? Why or why not? Hint: Think Income generated by inventory sold compared to the original investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts